Loading

Get Md Comptroller 515 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 515 online

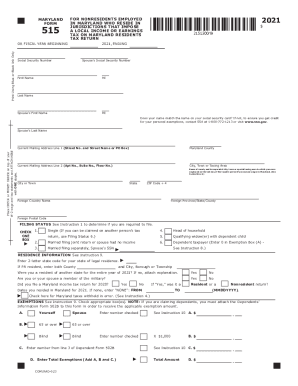

The MD Comptroller 515 form is essential for nonresidents employed in Maryland who reside in jurisdictions imposing a local income tax on Maryland residents. This guide provides clear, step-by-step instructions to assist users in efficiently completing the form online.

Follow the steps to fill out the MD Comptroller 515

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your personal information such as your name and Social Security Number. Make sure your name matches the one on your Social Security card to avoid issues with your personal exemptions.

- Input your current mailing address accurately, including street name, city, and ZIP code. If you’re using a foreign address, complete additional fields for the country and postal code.

- Select your filing status by checking the appropriate box. This status should reflect your federal filing status unless you are a dependent taxpayer.

- Provide your residency information, including your state of legal residence and other details required.

- Claim the appropriate exemptions by checking the boxes corresponding to yourself, your spouse (if applicable), and any dependents you may have.

- Fill in the income and adjustments section by entering your federal income, Maryland wage income, and other necessary details from your federal return.

- Complete the calculations for deductions, either choosing a standard or itemized deduction method, depending on which is more beneficial.

- Review your taxable net income and calculate the Maryland tax due based on the instructions provided, applying any relevant tax credits.

- Verify all provided information for accuracy, then save changes, download a copy for your records, and ensure you are ready to submit your return.

Complete your MD Comptroller 515 online today to ensure timely processing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Online Bill Pay is an easy, convenient and secure way to pay your Maryland tax liabilities online for free. This system may be used to make bill payments on business taxes using electronic funds withdrawal (direct debit) from a U.S. bank or financial institution. Foreign facilities will not be accepted.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.