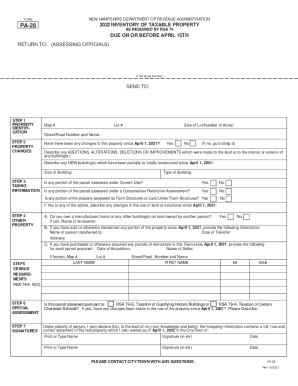

Get Nh Pa-28 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NH PA-28 online

How to fill out and sign NH PA-28 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Today, most Americans prefer to do their own income taxes and, in addition, to complete papers in electronic format. The US Legal Forms web-based platform makes the procedure of e-filing the NH PA-28 fast and handy. Now it will require not more than thirty minutes, and you can do it from any place.

Tips on how to finish NH PA-28 quick and easy:

-

Open the PDF template in the editor.

-

See the outlined fillable lines. Here you can put in your information.

-

Click on the variant to pick when you see the checkboxes.

-

Check out the Text icon and other advanced features to manually modify the NH PA-28.

-

Confirm all the details before you resume signing.

-

Make your exclusive eSignature by using a keyboard, camera, touchpad, computer mouse or cell phone.

-

Certify your web-template online and indicate the date.

-

Click on Done proceed.

-

Download or deliver the document to the receiver.

Ensure that you have filled in and delivered the NH PA-28 correctly in due time. Consider any applicable term. If you provide incorrect info with your fiscal reports, it can result in severe charges and cause problems with your yearly income tax return. Be sure to use only professional templates with US Legal Forms!

How to edit NH PA-28: customize forms online

Take advantage of the usability of the multi-featured online editor while filling out your NH PA-28. Make use of the range of tools to quickly fill out the blanks and provide the required information in no time.

Preparing paperwork is time-taking and costly unless you have ready-to-use fillable templates and complete them electronically. The most effective way to deal with the NH PA-28 is to use our professional and multi-functional online editing tools. We provide you with all the necessary tools for quick document fill-out and enable you to make any edits to your forms, adapting them to any requirements. Aside from that, you can comment on the updates and leave notes for other parties involved.

Here’s what you can do with your NH PA-28 in our editor:

- Fill out the blanks using Text, Cross, Check, Initials, Date, and Sign options.

- Highlight important details with a preferred color or underline them.

- Hide confidential information with the Blackout option or simply erase them.

- Import pictures to visualize your NH PA-28.

- Substitute the original text with the one corresponding with your needs.

- Leave comments or sticky notes to inform others on the updates.

- Place additional fillable areas and assign them to specific recipients.

- Protect the template with watermarks, add dates, and bates numbers.

- Share the document in various ways and save it on your device or the cloud in different formats once you finish modifying.

Working with NH PA-28 in our powerful online editor is the quickest and most efficient way to manage, submit, and share your documentation the way you need it from anywhere. The tool operates from the cloud so that you can access it from any place on any internet-connected device. All forms you generate or prepare are safely stored in the cloud, so you can always access them whenever needed and be assured of not losing them. Stop wasting time on manual document completion and eliminate papers; make it all online with minimum effort.

Step 1: Congrats on the new job! ... Step 2: Complete lines 1 to 4 of the 2019 W4 Form. ... Step 3: Skip lines 5 and 6 on the 2019 W4 Form and complete line 7. ... Step 4: Fill out the Personal Allowances Worksheet (Page 3)

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.