Loading

Get Dc Otr D-76 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC OTR D-76 online

Completing the DC OTR D-76 online is an essential step in managing estate tax for individuals who passed away. This guide provides an easy-to-follow roadmap, ensuring you fill out the form accurately and efficiently.

Follow the steps to successfully complete the DC OTR D-76 online.

- Use the ‘Get Form’ button to access the D-76 form and open it in the editor.

- Enter the date of birth and date of death of the decedent in the appropriate fields.

- Indicate whether you wish to authorize the Office of Tax and Revenue (OTR) to discuss your return with a third party by selecting 'Yes' and entering the name and phone number of the designee.

- Fill out the estate information section, answering all relevant questions about the estate. If the estate passes entirely to a spouse or a qualified charitable organization, you will complete the D-76EZ instead.

- Provide the personal representative's information if applicable, entering their name, Identification Number, email, phone, and address in the marked fields.

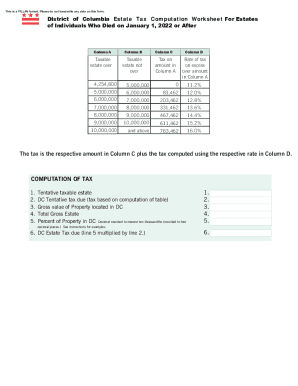

- Complete the gross estate section by inputting amounts from the relevant IRS Form 706 schedules.

- Enter deductions as listed in the instructions, including funeral expenses and debts.

- Calculate the total gross estate and the total allowable deductions, which MyTax will do automatically as you fill in the values.

- Review the computed values to ensure accuracy, especially the total gross estate and the taxable estate.

- If applicable, select the method for your refund deposit by entering the routing number, account type, and account number.

- Final checks: Ensure all fields are filled properly, review for accuracy, then save changes to download, print, or share the completed form.

Complete your DC OTR D-76 form online today to ensure compliance and timely filing.

The federal estate tax is collected on the transfer of a person's assets to heirs and beneficiaries after death. ... An estate valued at $10,000 more than the 2019 federal estate tax exemption is taxed at a rate of 18%, while an estate that exceeds the exemption amount by $1 million or more is taxed at 40%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.