Get Ks Dor Schedule S 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS DoR Schedule S online

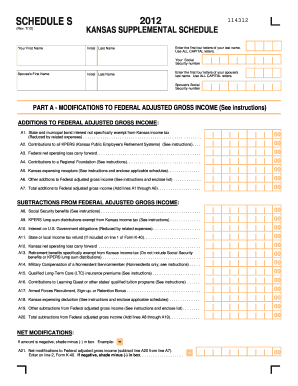

The KS DoR Schedule S is an essential document for reporting income modifications and allocation for Kansas residents and nonresidents. This guide will provide clear, step-by-step instructions to help you complete this form online, ensuring accuracy and compliance with state requirements.

Follow the steps to complete the KS DoR Schedule S online.

- Press the ‘Get Form’ button to obtain the KS DoR Schedule S and open it in your editor.

- Begin with entering your first name in the designated field, followed by the initial and the first four letters of your last name in all capital letters.

- Input your Social Security number in the appropriate field, then proceed to enter your spouse's first name and their last name using the same format as your own name.

- Next, fill in your spouse's Social Security number in the designated area.

- Move to Part A, where you will indicate any additions to your Federal adjusted gross income. Carefully review the instructions for lines A1 through A6 and provide the required amounts for each category, including state and municipal bond interest, contributions to KPERS, and others as applicable.

- Calculate the total additions to your Federal adjusted gross income and enter the result in line A7.

- Proceed to subtract any allowed deductions in the Subtractions section of Part A. Again, carefully provide amounts for the relevant lines A8 through A19, referencing any necessary instructions.

- Determine the total subtractions from your Federal adjusted gross income and enter it on line A20.

- Calculate the net modifications to Federal adjusted gross income by subtracting line A20 from line A7. If this amount is negative, shade minus (-) in the provided box and record the result on line A21.

- For nonresidents and part-year residents, move to Part B and fill out the income allocation section. Begin by entering your total income from your Federal return in the applicable fields B1 through B11.

- Calculate the total income from Kansas sources and enter it on line B12. Follow with adjustments and modifications, as detailed in lines B13 through B17, to arrive at the total federal adjustments to Kansas source income on line B18.

- Subtract line B18 from line B12 to find your Kansas source income after federal adjustments, entering this on line B19.

- Enter any net modifications applicable to Kansas source income and calculate the modified Kansas source income for entry on line B21. Finally, determine your Kansas adjusted gross income as outlined in line B22, and complete the nonresident allocation percentage on line B23.

- Review the completed form for accuracy and save your changes. You may choose to download, print, or share the KS DoR Schedule S as needed.

Complete your KS DoR Schedule S online today to ensure timely and accurate filing.

Get form

Schedule S serves as a documentation tool on tax returns that allows taxpayers to itemize particular types of income and deductions. This form helps provide clarity on your overall tax situation, particularly for sole proprietors and other individuals. By carefully filling out the KS DoR Schedule S, you can ensure all relevant income facets are considered in your tax assessment.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.