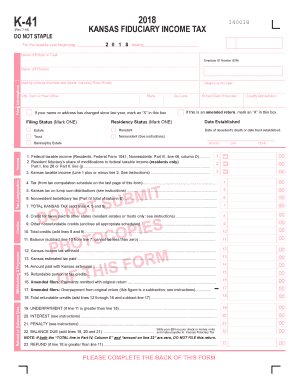

Get Ks Dor K-41 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign KS DoR K-41 online

How to fill out and sign KS DoR K-41 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Reporting your income and submitting all the necessary tax documents, including KS DoR K-41, is solely the duty of a US citizen. US Legal Forms makes your tax management more straightforward and precise.

You can access any legal forms you require and fill them out digitally.

Safeguard your KS DoR K-41 carefully. Ensure that all your relevant documents and information are organized while keeping in mind the deadlines and tax regulations set by the Internal Revenue Service. Simplify it with US Legal Forms!

- Obtain KS DoR K-41 directly in your web browser from any device.

- Click to open the fillable PDF document.

- Start completing the template field by field, following the instructions of the advanced PDF editor's interface.

- Carefully enter text and numerical data.

- Click on the Date box to automatically insert the current date or modify it manually.

- Utilize the Signature Wizard to create your personalized e-signature and sign in minutes.

- Refer to the IRS instructions if you have further inquiries.

- Click Done to save your changes.

- Proceed to print the document, download it, or send it via Email, text message, Fax, or USPS without leaving your browser.

How to Alter Get KS DoR K-41 2018: Personalize Forms Online

Your easily adjustable and adaptable Get KS DoR K-41 2018 template is within convenient access. Maximize our collection with an integrated online editor.

Do you delay finishing Get KS DoR K-41 2018 because you just don't know where to begin and how to proceed? We empathize with your situation and have a fantastic tool for you that has absolutely nothing to do with combating your procrastination!

Our online selection of ready-to-modify templates allows you to browse and choose from thousands of fillable forms tailored for various applications and situations. However, acquiring the form is merely the beginning. We provide you with all the necessary tools to finalize, authenticate, and adjust the document of your choice without leaving our website.

All you have to do is access the document in the editor. Review the wording of Get KS DoR K-41 2018 and verify if it's what you’re looking for. Start adjusting the form using the annotation tools to give your document a more structured and cleaner appearance.

In conclusion, in addition to Get KS DoR K-41 2018, you will receive:

Adherence to eSignature regulations governing the use of eSignature in online endeavors.

With our professional solution, your finalized documents are typically officially enforceable and entirely encrypted. We ensure the protection of your most confidential information. Acquire all you need to create a professional-looking Get KS DoR K-41 2018. Make the optimal choice and try our platform today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, redact, and amend the current text.

- If the document is intended for other users as well, you can include fillable fields and distribute them for additional parties to complete.

- Once you've finished modifying the template, you can download the file in any available format or select any sharing or delivery methods.

- A comprehensive set of editing and annotation instruments.

- An integrated legally-recognized eSignature solution.

- The capability to create documents from scratch or based on the pre-prepared template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for safeguarding your files.

- A broad array of delivery methods for easier sharing and dispatching of documents.

Get form

You can acquire Kansas tax forms at various locations, including local libraries and tax offices. Additionally, the Kansas Department of Revenue's website offers downloadable versions of these forms. For detailed guidance, refer to the KS DoR K-41 to ensure you have the right forms for your needs.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.