Loading

Get In Wh-1 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN WH-1 online

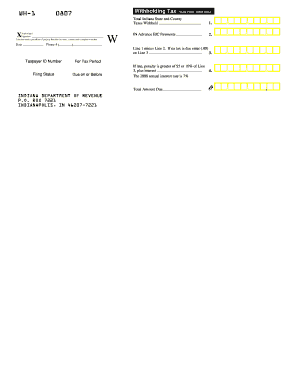

The IN WH-1 form is essential for reporting withholding tax in Indiana. This guide will walk you through each section of the form, ensuring you have the necessary information to complete it accurately and efficiently.

Follow the steps to complete the IN WH-1 form accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the taxpayer ID number section and enter your unique identification code. This number is vital for processing your form correctly.

- For the tax period, input the relevant month and year, specifying the period for which you are reporting taxes.

- Select your filing status. Ensure you indicate 'Monthly' if that is applicable to your situation.

- In the 'Total Indiana State and County Taxes Withheld' section, enter the total amount of all taxes that have been withheld during that period.

- If you have made advance earned income credit (EIC) payments, fill in this amount in the prescribed section.

- Subtract the amount on Line 2 from Line 1 to complete Line 3. If no tax is due, enter '.00' on Line 3.

- If your form is filed late, calculate the penalty based on the greater of $5 or 10% of Line 3, and add any interest that has accrued at the specified annual rate.

- Lastly, calculate and enter the total amount due in the designated area, ensuring all calculations are accurate.

- Review the entire form for completeness. Once satisfied, save your changes, and choose to download, print, or share the form as needed.

Complete your IN WH-1 online today for accurate and timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, New York has a state withholding form, which is known as the NYS-50 form. This form is used to report withholding taxes for employees and is essential for maintaining compliance with state tax laws. When filing your withholding taxes, using the NYS-50 form in conjunction with the IN WH-1 form ensures that your payroll records are accurate and comprehensive.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.