Get In State Form 9284 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN State Form 9284 online

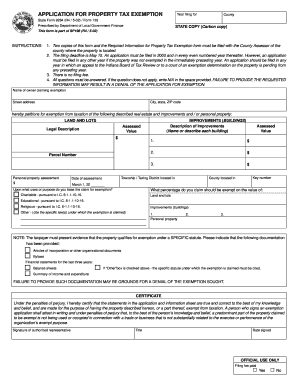

The IN State Form 9284 is crucial for individuals seeking property tax exemption in Indiana. This guide will provide you with clear, step-by-step instructions on how to fill out this form online, ensuring that your application is complete and submitted correctly.

Follow the steps to successfully complete the IN State Form 9284.

- Click ‘Get Form’ button to access the form and open it in the editor. This ensures you have the most current version of the document for accurate completion.

- Begin by entering the year you are filing for and your county in the designated fields. It is essential to ensure that these details are accurate as they determine the timeline of your exemption request.

- Provide all personal information required, including the name of the owner claiming the exemption, along with the street address, city, state, and ZIP code.

- In the section regarding the real estate and improvements, clearly describe the land and lots, as well as any improvements or buildings on the property. Include assessed values and legal descriptions as required.

- Fill in the personal property assessment details in their respective fields, including the parcel number and township or taxing district.

- State the purpose of the exemption claim by detailing how the property will be used. Indicate the percentage of exemption you are applying for under various categories such as charitable, educational, and religious.

- Ensure to provide the necessary documentation, such as articles of incorporation and financial statements from the last three years, to support your claim. This evidence is crucial for a successful exemption approval.

- Complete the certification section by signing with the authorized representative’s name, title, and the date. This attests that the information provided is accurate to the best of their knowledge.

- Finally, save your changes, then download or print the completed form for submission. Make sure to send two copies of this form along with the required documentation to the County Assessor's office by the deadline.

Ensure your property tax exemption application is completed and submitted correctly by following these steps online.

Get form

Related links form

In Indiana, there is no universal personal property tax exemption of $80,000. Instead, exemptions may vary based on local regulations and specific situations. To gain insight into available exemptions, including potential property tax reductions, it is advisable to file the IN State Form 9284 and consult with your local tax office. Learning about exemptions can help you better manage your property tax obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.