Loading

Get In State Form 9284 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN State Form 9284 online

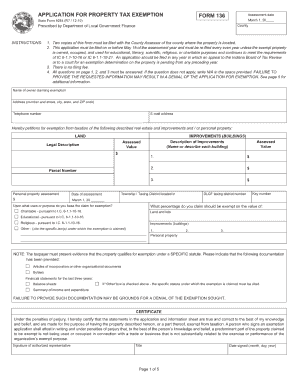

This guide will assist you in completing the IN State Form 9284 online with clarity and confidence. We will walk you through each section of the form, ensuring that you understand how to provide the required information accurately.

Follow the steps to successfully complete the form online

- Press the ‘Get Form’ button to access the IN State Form 9284 and open it in your preferred online editor.

- Locate the first section of the form, which typically requests your personal information. Fill in your full name, address, and contact details as required.

- Proceed to the next section that may ask for specific details related to the purpose of the form. Carefully read each prompt and provide the necessary information based on your situation.

- Review any additional fields that may require supplementary information or documentation. Ensure that you attach or input all relevant data as requested.

- Once you have completed all sections, take a moment to review your entries for accuracy. Make any necessary corrections before moving forward.

- Finally, save the changes you have made, and consider downloading, printing, or sharing the completed form according to your needs.

Complete your documents online with confidence and efficiency.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

For Minnesota state tax forms, you can visit the Minnesota Department of Revenue website, which provides downloadable forms. Additionally, local libraries or tax service offices may have them available. If your needs extend beyond Minnesota, remember that the IN State Form 9284 is available on Indiana's state website, ensuring access to diverse tax resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.