Loading

Get Ok Form 13-9 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK Form 13-9 online

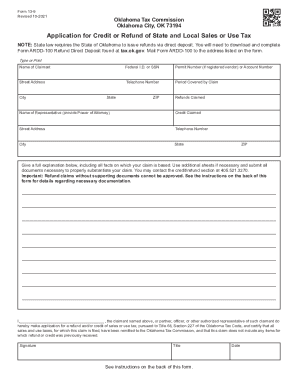

Filling out the OK Form 13-9 online can help streamline your application for a credit or refund of state and local sales or use tax. This guide will provide clear, step-by-step instructions to assist you in completing this form correctly.

Follow the steps to complete the OK Form 13-9 online.

- Click the ‘Get Form’ button to access the OK Form 13-9 and open it in your preferred editing interface.

- In the 'Name of Claimant' field, enter your full name as the person applying for the refund or credit. Ensure accuracy to avoid processing delays.

- Provide your Federal ID number or Social Security Number in the designated field to identify your application uniquely.

- If you are a registered vendor, include your Permit Number or Account Number. If not registered, write 'casual' in this space.

- Fill in your street address, city, state, and ZIP code to ensure proper correspondence and processing of your claim.

- Enter your telephone number for any necessary follow-up or communication regarding your application.

- Specify the period covered by the claim to clarify the exact timeframe of the tax in question.

- Indicate the total refunds claimed in the appropriate section, as well as any credit claimed, ensuring clarity between both amounts.

- If a representative is involved in the claim, enter their name and ensure you have the necessary Power of Attorney documentation available.

- In the space provided, give a detailed explanation of the basis for your claim. You may attach additional sheets if necessary and remember to include supporting documentation.

- Sign the form as the claimant or authorized representative, including your title if applicable, along with the current date.

- After completing the form, you can save the changes, download a copy for your records, print it out, or share it as needed.

Start completing your OK Form 13-9 online today for an efficient application process.

The Oklahoma Use Tax is a 4.5 percent levy on the purchase price of tangible personal property, including pre-paid transportation, purchased outside Oklahoma and stored, used, or otherwise consumed within the state. ... The municipal or county use tax may not exceed an existing local sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.