Loading

Get In It-40rnr 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN IT-40RNR online

Filling out the IN IT-40RNR form can be a straightforward process when you follow the proper steps. This guide is designed to help you navigate through the form in a clear and supportive manner, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete the IN IT-40RNR online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

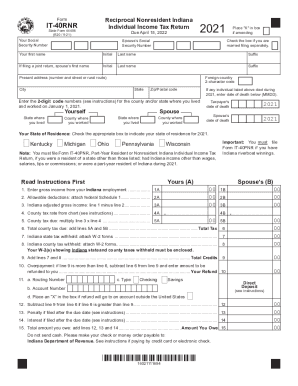

- Carefully read the instructions provided for the form before you begin filling it out. Gather necessary information such as your and your spouse's Social Security numbers, and details of your income.

- Enter your first name, middle initial, last name, and suffix in the respective fields. If you are filing jointly, also provide your spouse's name and information.

- Fill in your present address, including the number and street, city, state, and zip code. If applicable, indicate your foreign country code.

- Indicate your state of residence by checking the appropriate box corresponding to your living state as of January 1, 2021.

- For lines 1A and 1B, enter your gross income from employment in Indiana. Ensure that this includes only wages, salaries, tips, or commissions.

- Complete lines 2A and 2B to include any allowable deductions from your federal tax return, attaching federal Schedule 1 if applicable.

- Calculate your Indiana adjusted gross income on line 3 by subtracting line 2 from line 1; if the result is less than zero, leave it blank.

- For lines 4A and 4B, enter the county tax rate applicable to the county where you worked on January 1, 2021, as per the provided chart.

- Sum your Indiana state and county taxes withheld (lines 7 and 8), using the totals from your attached W-2 forms.

- If you qualify for a refund, complete lines 10 and line 11 with your bank account information for direct deposit.

- Review all entries for accuracy. Once confirmed, save your changes, and either download, print, or share the completed form as necessary.

Complete your IN IT-40RNR form online today to ensure your taxes are filed accurately and on time.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you earn only Social Security disability benefits, chances are good that you won't owe the IRS anything, and won't need to file a return, as long as you have no other sources of income, such as an interest-bearing savings account or rental property. ... If you file a joint return, this minimum rises to $32,000.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.