Loading

Get La Ldr R-1203 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR R-1203 online

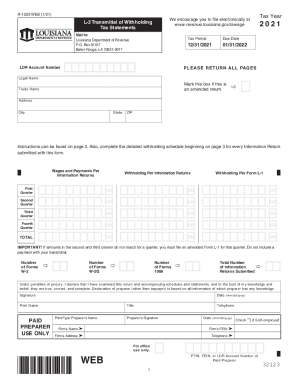

Filling out the LA LDR R-1203 is an essential process for submitting withholding tax statements to the Louisiana Department of Revenue. This guide will help you navigate the online form step by step, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete the LA LDR R-1203 online.

- Click ‘Get Form’ button to access the LA LDR R-1203 and open it in your preferred online editor.

- Enter the tax year at the top of the form where indicated. For example, you may enter '2021' for the fiscal year you are reporting.

- Fill in the LDR account number to identify your business with Louisiana Department of Revenue.

- Indicate the tax period by selecting the appropriate dates, typically including a due date like '01/31/2022'.

- Provide your legal name in the designated section and include the trade name if applicable.

- Complete your address details by entering your street address, city, state, and ZIP code.

- If applicable, mark the box to indicate that this is an amended return.

- Fill in the section for wages and payments based on your information returns for each quarter of the tax year.

- Provide the total withholding amounts as reported per information returns and confirm they match the amounts reported per Form L-1.

- Enter the number of Forms W-2, W-2G, and 1099 you are submitting, ensuring you provide accurate totals.

- Review the declaration section, sign, and date the form to validate your submission.

- If using a paid preparer, ensure they complete the 'Paid Preparer Use Only' section.

- Once all fields are filled, save the changes, download the completed form, and print if necessary, or prepare to submit it electronically.

Complete your LA LDR R-1203 online today to ensure timely filing and compliance with the Louisiana Department of Revenue.

Format: 9999999-999 (10 digits) Apply online at the DOR's Taxpayer Access Point portal to receive an Account Number immediately after registration or apply with this form. Find an existing Account Number: on Form L-1, Employer's Return of Income Tax Withheld. by calling the Dept of Revenue at (855) 307-3893.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.