Loading

Get La Ldr R-1201 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR R-1201 online

This guide provides a step-by-step approach to completing the LA LDR R-1201 form online. Whether you are familiar with tax reporting or new to the process, this resource will help you navigate each section with confidence.

Follow the steps to successfully complete your form:

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

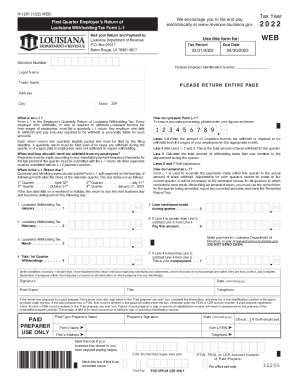

- Fill in the tax period and tax year at the top of the form. For the example provided, enter '03/31/2022' for the tax period and '2022' for the tax year.

- Enter your Account Number and Federal Employer Identification Number (EIN) in the designated fields.

- Provide the legal name and trade name of your business as required.

- Complete the address section, including city, state, and ZIP code.

- For lines 1-3, input the amount of Louisiana income tax withheld from employee wages for each respective month within the quarter.

- Add the amounts from lines 1, 2, and 3 to obtain the total withheld tax for the quarter on line 4.

- Review and calculate the total amount of tax withheld that was remitted to the department during the quarter for line 5.

- Follow the instructions regarding due dates for submitting your return, ensuring to file by the last day of the month following the quarter.

- Complete lines 6 and 7 regarding payment amounts and overpayment information respectively.

- Sign and date the form at the bottom, providing your printed name, title, and telephone number.

- If a paid preparer assisted you, they must also sign in the 'Paid preparer use only' section and provide their identification number.

- Once all fields are completed, save changes, and choose whether to download, print, or share the completed form.

Start filling out your LA LDR R-1201 online today to ensure timely filing and compliance.

Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary. ... Penalties will be imposed for willfully supplying false information or willful failure to supply information that would reduce the withholding exemption. This form must be filed with your employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.