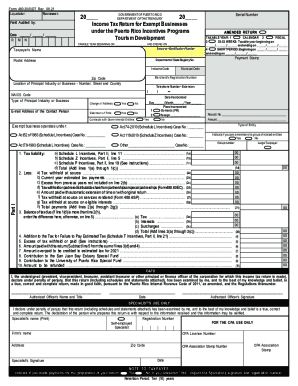

Get Pr 480.30(ii) 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PR 480.30(II) online

How to fill out and sign PR 480.30(II) online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax form completion can become a serious obstacle and severe headache if no correct assistance offered. US Legal Forms is developed as an web-based resolution for PR 480.30(II) e-filing and provides many advantages for the taxpayers.

Use the tips on how to complete the PR 480.30(II):

-

Get the template online within the specific section or via the Search engine.

-

Press the orange button to open it and wait until it?s loaded.

-

Go through the blank and stick to the recommendations. In case you have never completed the sample earlier, follow the line-to-line instructions.

-

Concentrate on the yellow-colored fields. These are fillable and require specific info to get placed. If you are unclear what data to insert, learn the guidelines.

-

Always sign the PR 480.30(II). Use the built-in instrument to produce the e-signature.

-

Click the date field to automatically insert the relevant date.

-

Re-read the sample to check on and modify it just before the submission.

- Hit the Done button on the top menu once you have completed it.

-

Save, download or export the completed form.

Utilize US Legal Forms to ensure secure and easy PR 480.30(II) completion

How to edit PR 480.30(II): customize forms online

Find the right PR 480.30(II) template and modify it on the spot. Streamline your paperwork with a smart document editing solution for online forms.

Your day-to-day workflow with paperwork and forms can be more efficient when you have everything that you need in one place. For example, you can find, get, and modify PR 480.30(II) in just one browser tab. If you need a particular PR 480.30(II), it is simple to find it with the help of the smart search engine and access it instantly. You do not need to download it or search for a third-party editor to modify it and add your data. All the instruments for productive work go in just one packaged solution.

This editing solution enables you to customize, fill, and sign your PR 480.30(II) form right on the spot. Once you discover an appropriate template, click on it to open the editing mode. Once you open the form in the editor, you have all the needed instruments at your fingertips. You can easily fill in the dedicated fields and remove them if necessary with the help of a simple yet multifunctional toolbar. Apply all the modifications instantly, and sign the form without leaving the tab by merely clicking the signature field. After that, you can send or print out your file if necessary.

Make more custom edits with available instruments.

- Annotate your file using the Sticky note tool by placing a note at any spot within the document.

- Add necessary visual components, if needed, with the Circle, Check, or Cross instruments.

- Modify or add text anywhere in the document using Texts and Text box instruments. Add content with the Initials or Date tool.

- Modify the template text using the Highlight and Blackout, or Erase instruments.

- Add custom visual components using the Arrow and Line, or Draw tools.

Discover new possibilities in efficient and trouble-free paperwork. Find the PR 480.30(II) you need in minutes and fill it out in in the same tab. Clear the mess in your paperwork for good with the help of online forms.

To request a Puerto Rico extension, file Form AS 2644 (Request for Extension of Time to File the Income Tax Return) by the original due date of your return. Form AS 2644 will give you 3 extra months to file your return, moving the filing deadline to July 15 (for calendar year taxpayers).

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.