Loading

Get In State Form 21926 - Schedule Lic 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN State Form 21926 - Schedule LIC online

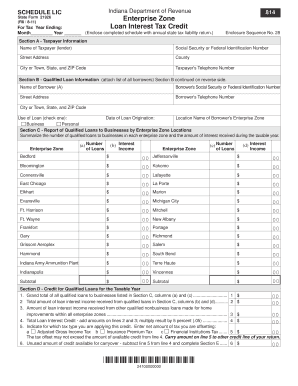

Filling out the IN State Form 21926 - Schedule LIC is an essential process for claiming the Enterprise Zone Loan Interest Tax Credit. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Begin by entering your taxpayer information in Section A. Fill in your name, Social Security or Federal Identification Number, street address, county, city or town, state, and ZIP code. Be sure to include your telephone number.

- Proceed to Section B to enter qualified loan information. Attach a list of all borrowers if necessary. For each borrower, include their name, Social Security or Federal Identification Number, street address, and telephone number. Specify the loan's use (business or personal) and the date of loan origination.

- In Section C, report the qualified loans to businesses by enterprise zone locations. Summarize the number of loans and the interest income received during the taxable year for each enterprise zone listed.

- Move to Section D to calculate the credit for qualified loans. Fill in the grand total of loans, the interest income received, and any additional information as outlined in the form instructions. Ensure calculations are accurate.

- Complete Section E if you have any unused credit available for carryover. Identify the initial tax period for which the credit was claimed and provide necessary details for each following tax year.

- Finally, sign and date the form in Section F. Ensure that the information provided is correct and complete.

- After completing the form, you can save your changes, download it, print a copy, or share it as needed.

Start filing your IN State Form 21926 - Schedule LIC online today!

Related links form

Individuals who earn income in Indiana but do not reside there must file an Indiana nonresident return. This includes anyone working in the state, even if they live elsewhere. Using the IN State Form 21926 - Schedule LIC is crucial for accurately reporting your Indiana earnings and calculating any tax owed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.