Loading

Get Ca Ftb 3500a 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3500A online

Filling out the CA FTB 3500A form can seem overwhelming, but with clear instructions, you can complete it smoothly. This guide will walk you through each section of the form and provide essential tips for submitting your exemption request.

Follow the steps to successfully complete your CA FTB 3500A form online.

- Click ‘Get Form’ button to acquire the CA FTB 3500A form and open it in the designated editor.

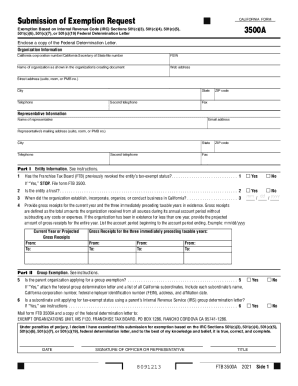

- Begin by entering the organization information, including the California corporation number or Secretary of State file number, FEIN, name of the organization, web address, street address, city, state, telephone numbers, ZIP code, and fax number.

- Provide the representative's information by entering their name, email address, and mailing address, including any suite, room, or PMB number, city, state, telephone numbers, ZIP code, and fax number.

- In Part I, indicate whether the Franchise Tax Board has previously revoked the entity’s tax-exempt status. If yes, it directs you to file form FTB 3500 instead. Proceed to answer if the entity is a trust and provide the establishment date in California.

- List the gross receipts for the current year and the three preceding taxable years. If less than one year old, project the gross receipts for the entire year, including the account period start and end dates.

- Respond to the group exemption questions, indicating if a subordinate unit is applying for tax-exempt status using a parent's IRS group determination letter and whether the parent organization is applying for a group exemption.

- Complete the purpose and activity section by checking the appropriate primary purpose(s) and activities that align with the IRS exemption categories under 501(c) organizations.

- Finally, review all entries for accuracy. Sign the form, include the date, title, and the signature of an officer or representative, then prepare to submit.

- Mail the completed CA FTB 3500A form along with a copy of the federal determination letter to the Exempt Organizations Unit at the address provided.

Start filing your CA FTB 3500A form online today for a seamless exemption request process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A Letter of Determination is the official, written documentation of the Internal Revenue Service's approval of a nonprofit's request for 501(c), tax-exempt status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.