Loading

Get Ny Nyc-1127 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY NYC-1127 online

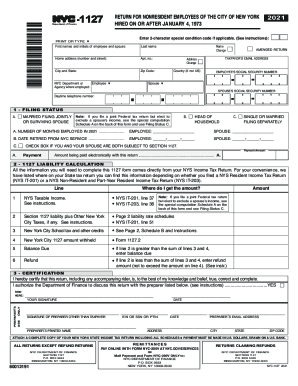

The NY NYC-1127 is a crucial document for nonresident employees of the City of New York hired on or after January 4, 1973. This guide will provide clear, step-by-step instructions to assist you in successfully completing the form online.

Follow the steps to effectively complete the NY NYC-1127 form.

- Use the ‘Get Form’ button to access the NYC-1127 form. This action will open the document in a suitable editor for filling out.

- Begin with your personal information. Enter the first names and initials of the employee and their partner, last name, home address, apartment number, city, state, and zip code.

- Provide the specific NYC department or agency where you are employed. If applicable, include any changes in name or address.

- If necessary, enter a 2-character special condition code based on the provided instructions.

- Fill in the employee's and partner's Social Security numbers, daytime telephone number, and email address.

- Select your filing status by marking the appropriate box: Married filing jointly or surviving spouse, head of household, single, or married filing separately. Be aware of additional instructions if you’re filing jointly but excluding your partner's income.

- Complete sections related to months employed in 2021, date retired from NYC service, and any applicable liabilities.

- Move to the liability calculation section. Reference your New York State income tax return to fill in the required amounts.

- In the certification section, confirm the accuracy of your return and provide your signature along with the date.

- Finally, review your completed form for any errors, and save your changes. You can then download, print, or share the form as needed.

Complete your documents online to ensure a smooth filing experience.

New York, for instance, requires that anyone who comes for business must file a nonresident return for income earned from day one. But those travelers' employers are only required to start withholding New York tax if they work in the state for at least 14 days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.