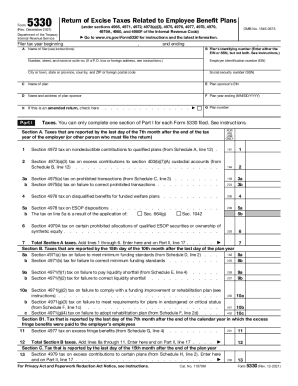

Get Irs 5330 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5330 online

How to fill out and sign IRS 5330 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If people aren?t associated with document administration and law processes, submitting IRS forms will be extremely nerve-racking. We understand the necessity of correctly finalizing documents. Our online software offers the way to make the process of processing IRS forms as easy as possible. Follow this guideline to quickly and properly fill out IRS 5330.

The way to complete the IRS 5330 online:

-

Click the button Get Form to open it and start editing.

-

Fill all needed lines in the file using our professional PDF editor. Switch the Wizard Tool on to complete the procedure much easier.

-

Make sure about the correctness of filled information.

-

Add the date of completing IRS 5330. Use the Sign Tool to create a special signature for the file legalization.

-

Finish modifying by clicking on Done.

-

Send this document straight to the IRS in the easiest way for you: via email, using digital fax or postal service.

-

You have a possibility to print it on paper when a hard copy is needed and download or save it to the preferred cloud storage.

Making use of our service will make skilled filling IRS 5330 a reality. We will make everything for your comfortable and secure work.

How to edit IRS 5330: customize forms online

Go with a rock-solid document editing solution you can trust. Edit, execute, and sign IRS 5330 safely online.

Too often, working with forms, like IRS 5330, can be pain, especially if you got them online or via email but don’t have access to specialized tools. Of course, you can use some workarounds to get around it, but you can end up getting a form that won't meet the submission requirements. Using a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We offer a smoother and more streamlined way of modifying forms. A comprehensive catalog of document templates that are straightforward to change and certify, making fillable for other individuals. Our platform extends way beyond a collection of templates. One of the best parts of utilizing our services is that you can revise IRS 5330 directly on our website.

Since it's a web-based option, it spares you from having to download any application. Additionally, not all company rules allow you to install it on your corporate laptop. Here's the best way to easily and safely execute your forms with our platform.

- Hit the Get Form > you’ll be instantly taken to our editor.

- As soon as opened, you can start the editing process.

- Select checkmark or circle, line, arrow and cross and other choices to annotate your form.

- Pick the date field to include a specific date to your template.

- Add text boxes, graphics and notes and more to enrich the content.

- Use the fillable fields option on the right to create fillable {fields.

- Select Sign from the top toolbar to generate and create your legally-binding signature.

- Hit DONE and save, print, and share or download the document.

Say goodbye to paper and other ineffective ways of completing your IRS 5330 or other documents. Use our solution instead that includes one of the richest libraries of ready-to-edit forms and a robust document editing services. It's easy and safe, and can save you lots of time! Don’t take our word for it, give it a try yourself!

Excise taxes are taxes required on specific goods or services like fuel, tobacco, and alcohol. Excise taxes are primarily taxes that must be paid by businesses, usually increasing prices for consumers indirectly. Excise taxes can be ad valorem (paid by percentage) or specific (cost charged by unit).

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.