Loading

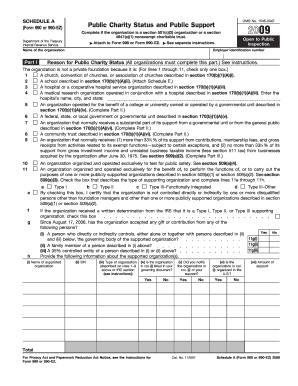

Get Irs 990 - Schedule A 2009

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule A online

Filling out the IRS 990 - Schedule A can be a crucial process for organizations seeking public charity status. This guide is designed to provide clear, step-by-step instructions to assist you in completing this important form online.

Follow the steps to successfully complete the IRS 990 - Schedule A.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the organization and the employer identification number (EIN) in the designated fields.

- Complete Part I by checking the appropriate box that describes the reason for public charity status. Ensure you check only one box.

- If applicable, provide information in the additional sections regarding gifts received from specified persons and supported organizations.

- Proceed to Part II if relevant, and complete the public support section, providing details for each year requested.

- Continue to fill out the total support section, adding up all relevant financial information.

- Complete any necessary calculations for the public support percentage in the computation sections.

- If applicable, fill out Part III related to organizations described in section 509(a)(2) by providing similar details as required in Part II.

- Finish by providing supplemental information as needed in Part IV, including any explanations required by previous sections.

- Finally, review all entries for accuracy, then save your changes, download, print, or share the form as needed.

Start the process of completing your IRS 990 - Schedule A online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

An organization should use this schedule, rather than separate attachments, to provide the IRS with narrative information required for responses to specific questions on Form 990 or 990-EZ, and to explain the organization's operations or responses to various questions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.