Loading

Get Irs Instructions 1040 Schedule C 2021

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 1040 Schedule C online

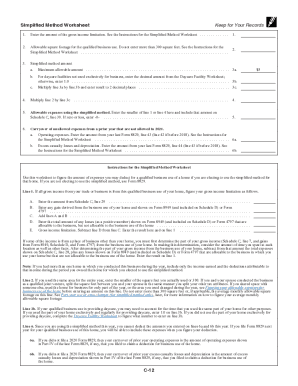

Filling out the IRS Instructions 1040 Schedule C online can seem daunting, but it is essential for reporting your business income and expenses accurately. This guide will provide you with step-by-step instructions to simplify the process, ensuring you understand each component of the form.

Follow the steps to complete your Schedule C effectively.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Start by filling out your business name and address in the appropriate fields. If your business operates under a different name, ensure you indicate that correctly.

- Enter your Employer Identification Number (EIN) if applicable. If you do not have one, you can leave this field blank.

- On Line A, describe the type of business or professional activity you engage in. Be specific about the services or products you provide.

- Enter the six-digit code from the Principal Business or Professional Activity Codes chart that corresponds to your primary business activity on Line B.

- In Part I, report all income you’ve earned from the business during the year in the income section. Start with gross receipts from your business on Line 1.

- Deduct returns and allowances by entering the amount on Line 2. This represents any refunds or credits you've issued to your customers.

- Proceed to calculate your total income by summing up the amounts for each line in the income section.

- In Part II, document your business expenses in the respective lines, making sure to list categories such as business use of your home, utility expenses, and other relevant deductions.

- Complete Part III if you had cost of goods sold. This includes inventory and associated expenses.

- Finally, review your entries and calculate your net profit or loss on Line 31 by subtracting total expenses from total income.

- Once all sections are complete, you can save your changes, download, print, or share the form as necessary.

Start filling out your Schedule C online today to ensure accurate reporting of your business income and expenses!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

QBI is the net amount of qualified items of income, gain, deduction and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and certain trusts.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.