Loading

Get Irs 1120s - Schedule K-1 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120S - Schedule K-1 online

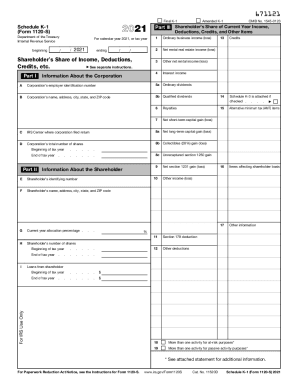

Filling out the IRS 1120S - Schedule K-1 is an important task for shareholders of an S Corporation. This form reports your share of the corporation's income, deductions, and credits for the tax year, enabling you to accurately file your personal tax return.

Follow the steps to complete your IRS 1120S - Schedule K-1 online.

- Click 'Get Form' button to access the IRS 1120S - Schedule K-1 and open it in your browser or preferred editing tool.

- Enter the corporation’s employer identification number in the designated field. This number is essential for identifying the business entity that you are a shareholder in.

- Provide the corporation's name, address, city, state, and ZIP code. Accurate information is critical for tax identification purposes.

- Fill in your identifying number as a shareholder, along with your name, address, and other personal information as requested in Part II.

- Review Part III to report your share of the corporation’s income, deductions, credits, and more. Carefully enter figures such as ordinary business income, rental income, and dividends.

- If applicable, check the box related to Schedule K-3 to indicate any additional reporting information required for your tax situation.

- Once all entries are completed and verified for accuracy, you can save changes to the form. Consider downloading or printing a copy for your records before submitting.

- Share the completed Schedule K-1 with your accountant or include it with your personal tax return to ensure proper reporting.

Complete your IRS 1120S - Schedule K-1 online and stay organized for tax season!

If a shareholder materially participates in the operations of an S corporation, the passthrough of nonseparately stated (ordinary) income or loss is nonpassive. The income or loss passed through is passive if the shareholder does not materially participate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.