Loading

Get Irs 8283 2021

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8283 online

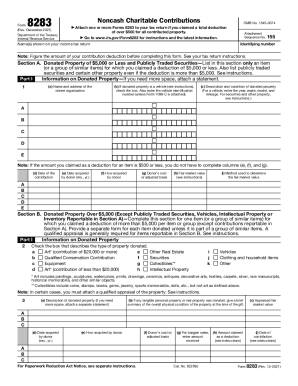

The IRS 8283 form is essential for reporting noncash charitable contributions exceeding $500. This guide provides clear, step-by-step instructions to help individuals fill out this form online, ensuring accurate completion and enhanced understanding.

Follow the steps to complete the IRS 8283 accurately.

- Click ‘Get Form’ button to access the form and open it in your preferred document editor.

- Begin by filling in your identifying information, including your taxpayer identification number and name as shown on your income tax return.

- In Section A, list the property donated with a fair market value of $5,000 or less. Provide details such as the donee organization's name and address, the date of contribution, and the description and condition of the donated property.

- If applicable, indicate if the donated property is a vehicle and provide the vehicle identification number. Include the method used to determine its fair market value.

- Proceed to Section B for donated property valued over $5,000. Describe the donated property type and attach a qualified appraisal if required.

- Complete details about the donated items, including the appraised fair market value, the date you acquired the property, and how you acquired it.

- For partial interests or restrictions on property use, complete Part II and provide all requested information.

- In Part III, if any item’s value is $500 or less, list these items.

- Sign the declaration of appraisal and complete the appraiser's details if an appraisal is necessary.

- Finally, complete the donee acknowledgment section, ensuring the charitable organization’s details and signatures are included.

- After reviewing the completed form for accuracy, you may save your changes, download the form, print it for your records, or share it as needed.

Complete your IRS 8283 online today to ensure your charitable contributions are accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Before tax reform, those who itemized could generally deduct charitable contributions up to 50% of their adjusted gross income. Tax reform bumped that limit up to 60%. ... Many who itemized their deductions on their 2017 tax returns probably won't itemize for their 2018 returns (which they'll file in 2019).

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.