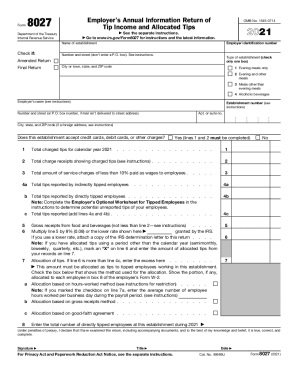

Get Irs 8027 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8027 online

How to fill out and sign IRS 8027 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren?t connected to document administration and law procedures, submitting IRS forms seems nerve-racking. We comprehend the value of correctly finalizing documents. Our online software offers the way to make the process of submitting IRS docs as easy as possible. Follow these tips to properly and quickly fill out IRS 8027.

How to complete the IRS 8027 online:

-

Select the button Get Form to open it and begin editing.

-

Fill out all needed fields in the doc using our professional PDF editor. Switch the Wizard Tool on to finish the process even easier.

-

Make sure about the correctness of added details.

-

Add the date of completing IRS 8027. Utilize the Sign Tool to make a special signature for the record legalization.

-

Finish editing by clicking on Done.

-

Send this file to the IRS in the most convenient way for you: via electronic mail, making use of digital fax or postal service.

-

You are able to print it on paper if a hard copy is needed and download or save it to the favored cloud storage.

Making use of our service will make professional filling IRS 8027 a reality. make everything for your comfortable and simple work.

How to edit IRS 8027: customize forms online

Put the right document management capabilities at your fingertips. Complete IRS 8027 with our reliable tool that comes with editing and eSignature functionality}.

If you want to complete and sign IRS 8027 online without hassle, then our online cloud-based solution is the ideal solution. We offer a wealthy template-based catalog of ready-to-use paperwork you can edit and fill out online. In addition, you don't need to print out the document or use third-party solutions to make it fillable. All the necessary features will be available for your use as soon as you open the file in the editor.

Let’s go through our online editing capabilities and their main features. The editor features a self-explanatory interface, so it won't take a lot of time to learn how to use it. We’ll take a look at three main sections that let you:

- Edit and annotate the template

- Arrange your documents

- Make them shareable

The top toolbar has the features that help you highlight and blackout text, without images and visual elements (lines, arrows and checkmarks etc.), sign, initialize, date the form, and more.

Use the toolbar on the left if you wish to re-order the form or/and remove pages.

If you want to make the document fillable for other people and share it, you can use the tools on the right and add different fillable fields, signature and date, text box, etc.).

In addition to the capabilities mentioned above, you can safeguard your file with a password, put a watermark, convert the file to the needed format, and much more.

Our editor makes modifying and certifying the IRS 8027 a piece of cake. It allows you to make virtually everything concerning working with documents. Moreover, we always ensure that your experience editing documents is secure and compliant with the major regulatory criteria. All these aspects make using our tool even more enjoyable.

Get IRS 8027, make the necessary edits and changes, and download it in the preferred file format. Give it a try today!

Get form

Generally, you must report the tips allocated to you by your employer on your income tax return. Attach Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to Form 1040, U.S. Individual Income Tax Return, to report tips allocated by your employer (in Box 8 of Form W-2).

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.