Get Irs 1040 - Schedule 8812 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040 - Schedule 8812 online

How to fill out and sign IRS 1040 - Schedule 8812 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax season started unexpectedly or maybe you just misssed it, it could probably cause problems for you. IRS 1040 - Schedule 8812 is not the simplest one, but you have no reason for panic in any case.

Making use of our powerful platform you will learn how to complete IRS 1040 - Schedule 8812 even in situations of critical time deficit. All you need is to follow these easy instructions:

-

Open the record with our advanced PDF editor.

-

Fill in the details required in IRS 1040 - Schedule 8812, making use of fillable fields.

-

Insert photos, crosses, check and text boxes, if needed.

-

Repeating fields will be filled automatically after the first input.

-

In case of misunderstandings, turn on the Wizard Tool. You will receive useful tips for much easier finalization.

-

Never forget to add the date of filing.

-

Make your unique signature once and put it in the required lines.

-

Check the info you have input. Correct mistakes if required.

-

Click on Done to complete editing and select how you will deliver it. You have the ability to use virtual fax, USPS or electronic mail.

-

It is possible to download the file to print it later or upload it to cloud storage like Google Drive, OneDrive, etc.

With this powerful digital solution and its helpful tools, submitting IRS 1040 - Schedule 8812 becomes more convenient. Do not hesitate to use it and spend more time on hobbies and interests instead of preparing paperwork.

How to edit IRS 1040 - Schedule 8812: customize forms online

Choose the right IRS 1040 - Schedule 8812 template and edit it on the spot. Simplify your paperwork with a smart document editing solution for online forms.

Your day-to-day workflow with paperwork and forms can be more effective when you have everything you need in one place. For instance, you can find, obtain, and edit IRS 1040 - Schedule 8812 in a single browser tab. If you need a specific IRS 1040 - Schedule 8812, it is simple to find it with the help of the smart search engine and access it right away. You don’t need to download it or search for a third-party editor to edit it and add your details. All of the instruments for efficient work go in a single packaged solution.

This modifying solution enables you to customize, fill, and sign your IRS 1040 - Schedule 8812 form right on the spot. Once you see a suitable template, click on it to open the modifying mode. Once you open the form in the editor, you have all the needed tools at your fingertips. You can easily fill in the dedicated fields and erase them if needed with the help of a simple yet multifunctional toolbar. Apply all the changes right away, and sign the form without exiting the tab by simply clicking the signature field. After that, you can send or print out your file if necessary.

Make more custom edits with available tools.

- Annotate your file with the Sticky note tool by putting a note at any spot within the document.

- Add required graphic elements, if required, with the Circle, Check, or Cross tools.

- Modify or add text anywhere in the document using Texts and Text box tools. Add content with the Initials or Date tool.

- Modify the template text with the Highlight and Blackout, or Erase tools.

- Add custom graphic elements with the Arrow and Line, or Draw tools.

Discover new possibilities in efficient and trouble-free paperwork. Find the IRS 1040 - Schedule 8812 you need in minutes and fill it out in in the same tab. Clear the mess in your paperwork once and for all with the help of online forms.

Get form

Related links form

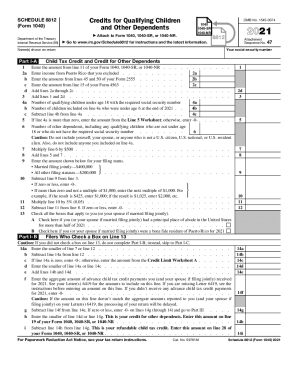

Form 1040 (Schedule 8812) efile it, Additional Child Tax Credit, is used to figure out if you qualify for the credit and to calculate the amount of the credit you will receive. Efile.com will do all required math and generate the form for you when you prepare your return.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.