Loading

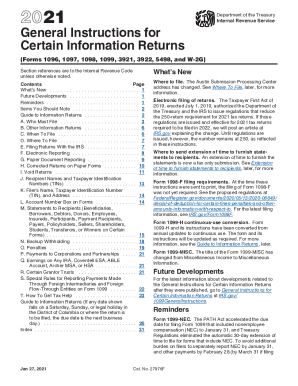

Get Irs General Instructions For Certain Information Returns 2021

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS General Instructions For Certain Information Returns online

Filling out the IRS general instructions for certain information returns can seem daunting. This guide provides clear, step-by-step instructions to help you complete the necessary forms accurately and efficiently while utilizing online resources.

Follow the steps to complete the IRS information returns for 2021.

- Press the ‘Get Form’ button to download the required form and access it in the document editor.

- Identify which specific form you need from the list of forms included in the instructions (e.g., 1096, 1097, 1098, 1099, 3921, 3922, 5498, or W-2G) and ensure you have the correct form downloaded.

- Carefully read through the updated sections and reminders regarding any changes for the 2021 tax year, including electronic and paper filing deadlines.

- Fill out the form by entering accurate recipient information, including names and taxpayer identification numbers (TINs) as specified in the instructions.

- Calculate and input any required amounts based on the reporting rules that apply to your specific situation (e.g., interest, dividends, cancellations of debt).

- Review all entered information for accuracy, ensuring alignment with IRS guidelines to avoid penalties for incorrect submissions.

- Save your completed form electronically and create a backup copy for your records. You can download, print, or share your filled-out form if needed.

Take the next step by completing your IRS forms online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The general rule is that you must issue a Form 1099-MISC to any vendors or sub-contractors you have paid at least $600 in rents, services, prizes and awards, or other income payments in the course of your trade/business in a given tax year (you do not need to issue 1099s for payments made for personal purposes).

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.