Loading

Get Irs 8829 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8829 online

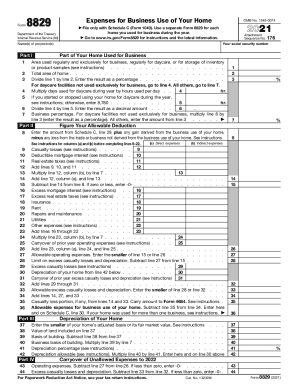

The IRS Form 8829 is crucial for individuals looking to claim expenses for the business use of their home. This guide provides clear and detailed instructions to help you navigate each section of the form effectively.

Follow the steps to fill out the IRS 8829 easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your social security number in the designated field at the top of the form.

- In 'Part I', specify the area of your home used for business. Enter the total square footage of your home and the area exclusively used for business. Calculate the percentage of your home used for business.

- Proceed to 'Part II' to figure your allowable deduction. Multiply the business percentage from the previous step by relevant income and expenses.

- In 'Part III', enter your allowed deductions by specifying direct and indirect expenses, as well as any allowable rates for depreciation.

- Complete 'Part IV' by detailing casualty losses and relevant limits to expenses or depreciation.

- Once all sections are filled out accurately, review your entries for completeness and any required calculations.

- Lastly, save your changes, and as needed, download, print, or share the form with your tax professional or for your records.

Start filling out your IRS 8829 online to make the most of your home business deductions.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.