Loading

Get Irs W-8ben 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-8BEN online

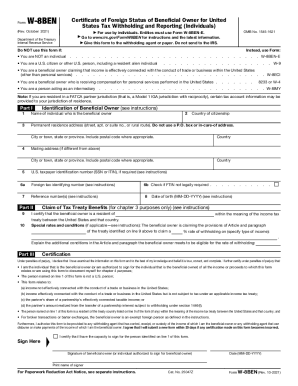

The IRS W-8BEN form is essential for individuals who are not U.S. citizens or residents to certify their foreign status for tax withholding purposes. Completing this form online can streamline your filing process and ensure compliance with U.S. tax regulations.

Follow the steps to complete the W-8BEN form online.

- Press the ‘Get Form’ button to access the IRS W-8BEN form and open it in your preferred online editor.

- In Part I, identify the beneficial owner by entering their full name in line 1.

- Enter the permanent residence address in line 2, ensuring to include the complete street address without using a P.O. box.

- In line 3, specify the country of citizenship.

- Complete lines 4 and 5 with the mailing address if it differs from the permanent residence address.

- Fill out line 6a with the U.S. taxpayer identification number (SSN or ITIN) if required.

- If you do not have a foreign tax identifying number, check the box in line 6b.

- Input the reference number(s) in line 7 if applicable.

- Provide the date of birth in line 8 using the MM-DD-YYYY format.

- In Part II, specify the country in line 9 where the beneficial owner is a resident for tax treaty benefits.

- Indicate the provisions being claimed on the tax treaty in line 10 and the applicable withholding rate.

- Explain any additional conditions in line 11 that qualify for the specified withholding rate.

- Proceed to Part III and certify the information by signing the form, entering the date, and providing your printed name.

- Once completed, you can save changes, download, print, or share the W-8BEN form.

Complete your IRS W-8BEN form online today for seamless tax compliance.

A W-8BEN (Individual) completed without a US taxpayer identification number, is in effect beginning on the date signed until the last day of the third succeeding calendar year, in general three years. If a change in circumstances causes any information on the form to be incorrect, this will render the form invalid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.