Loading

Get In It-40rnr 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN IT-40RNR online

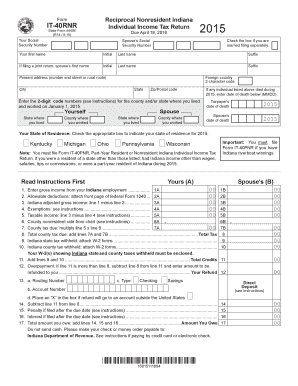

Filling out the IN IT-40RNR online can be a straightforward process if you follow the correct steps. This guide will provide clear instructions for each section of the form, ensuring that you complete it accurately and confidently.

Follow the steps to successfully complete your IN IT-40RNR online.

- Press the ‘Get Form’ button to obtain the form, ensuring it opens for editing.

- Enter your personal information, including your first name, initial, last name, and suffix. If you are filing jointly, also input your partner’s details in the corresponding fields.

- Provide your present address including the street number, city, state, and zip/postal code. Fill in the foreign country code if applicable.

- Indicate your state of residence for 2015 by checking the appropriate box. Make sure to note any counties in which you worked.

- Complete the income information section by entering your gross income from Indiana employment and any allowable deductions from your federal Form 1040.

- Calculate your Indiana adjusted gross income by subtracting your deductions from your gross income.

- Record the exemptions you qualify for and calculate your taxable income.

- Determine your county nonresident tax rate from the provided chart and apply it to your taxable income to figure the county tax due.

- Ensure to include all relevant Indiana state and county taxes withheld from your W-2 forms.

- If expecting a refund, fill out the direct deposit section accurately, including routing and account numbers.

- Review your completed form for accuracy, then save your changes. You may then download, print, or share the finished form.

Start filling out your IN IT-40RNR online today for a seamless tax return process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When filling out your tax withholding form, ensure you provide accurate personal information, including filing status and number of allowances. Use the IRS guidelines to assess your tax situation and adjust your allowances accordingly. Completing this form accurately helps prevent under or over-withholding, making your tax process smoother.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.