Loading

Get Sc Dor Fs-102 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR FS-102 online

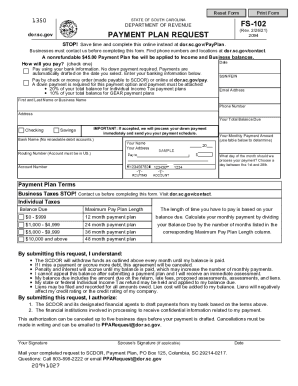

The SC DoR FS-102 form is essential for individuals or businesses looking to request a payment plan with the South Carolina Department of Revenue. This guide will provide you with clear, step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete your payment plan request

- Click 'Get Form' button to obtain the form and open it in a user-friendly online format.

- Provide your personal information in the designated fields. Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN), email address, first and last name or business name, phone number, and address.

- Indicate your total balance due. This is the full amount you owe to the South Carolina Department of Revenue.

- Choose how you will make your payments. Select either the option to pay using your bank information, which requires no down payment and allows for automatic drafts, or the option to pay by check or money order, which necessitates a down payment.

- Fill in your banking information only if you selected to pay using bank information. Include the bank name, routing number (ensure the account is in the US), and account number.

- Determine your monthly payment amount using the provided table. This will depend on your balance due and the selected maximum payment plan length.

- Select the day of the month you would like your payments to be processed, choosing a date from the 1st to the 28th.

- Review the terms of the payment plan outlined in the form. Ensure you understand the implications of submitting the request, including penalties for missed payments or accruing additional debt.

- Provide your electronic signature and, if applicable, the signature of your partner.

- After completing the form, save your changes. You can then download, print, or share the form as needed.

Complete your SC DoR FS-102 payment plan request online today for a simpler way to manage your tax obligations.

Related links form

South Carolina is very tax-friendly toward retirees South Carolina's tax code is great for retirees; not only is Social Security not taxable, but there's a sizable deduction for other kinds of retirement income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.