Loading

Get Ny Dtf Ct-3 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-3 online

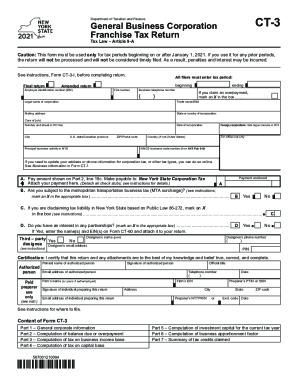

Filling out the NY DTF CT-3 form is essential for general business corporations in New York to report their franchise tax. This guide provides a step-by-step approach to help users effectively complete the form online and ensure compliance with New York tax regulations.

Follow the steps to complete your NY DTF CT-3 form online.

- Click ‘Get Form’ button to obtain the CT-3 form and open it in the editor. This allows you to digitally fill out the necessary fields.

- Enter your employer identification number (EIN) and tax period details, including the beginning and ending durations. Make sure these dates are accurate to avoid any processing issues.

- Input the legal name and trade name (if applicable) of your corporation. Provide the mailing address and your state or country of incorporation.

- Complete Part 1, which includes general corporate information and qualifications for preferential tax rates. Mark any applicable boxes regarding your business status.

- Proceed to Part 2 to compute your balance due or overpayment. This section requires calculations based on your tax liabilities.

- In Part 3, calculate the tax on your business income base by filling in federal taxable income and necessary adjustments.

- Continue to Part 4 to compute the tax on your capital base. Input relevant details about your assets and liabilities as outlined.

- In Part 5, determine the investment capital for the current tax year. This requires detailed reporting of capital contributions and liabilities.

- Fill out Part 6 to calculate your business apportionment factor. Ensure all values correspond accurately to your operational geography.

- Finally, summarize your tax credits claimed in Part 7 and ensure all applicable forms are attached. This may help reduce your overall tax obligation.

- After completing all sections, review your entries for accuracy. Once confirmed, you can save your changes, download a copy of the form, or print it for your records.

Complete your NY DTF CT-3 form online to ensure compliance and avoid penalties.

This tax, known popularly as the "mobility tax," is intended to provide funds for the Metropolitan Transportation Authority, which transports many of the region's commuters. Philadelphia has a 3.924% wage tax on residents and a 3.495% tax on non-residents for wages earned in the city as of August 2013.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.