Get Mi Uia 4101 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI UIA 4101 online

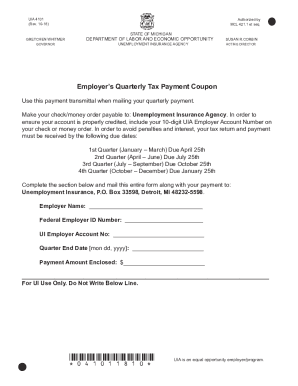

The MI UIA 4101 is a crucial form used by employers in Michigan to submit their quarterly tax payment for unemployment insurance. This guide will provide clear, step-by-step instructions to help users complete the form accurately and effectively online.

Follow the steps to complete the MI UIA 4101 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer’s name into the designated field. Ensure the name is accurate to avoid any potential issues with processing your payment.

- Provide the Federal Employer ID Number in the specified section. This number is essential for the identification of your business.

- Fill in your UI Employer Account Number. This 10-digit number helps to ensure your payment is credited to the correct account.

- Enter the Quarter End Date in the format [month day, year]. This date indicates the end of the reporting period for which you are making a payment.

- Specify the Payment Amount Enclosed in the appropriate field. Ensure that this amount reflects the total payment you are submitting.

- Once all required fields are completed, review the form for accuracy. Make any necessary corrections before proceeding.

- After final review, you can save changes, download the form, print it, or share it as needed to complete your submission.

Complete your MI UIA 4101 form online today to ensure timely processing of your unemployment insurance payment.

The EIN is a nine-digit number in the format 12-3456789. For security reasons, your employer is not legally required to list its EIN on pay stubs, but it is common practice and the most convenient place to look. Call your employer's human resources department and ask for its EIN.

Fill MI UIA 4101

Complete the section below and mail this entire form along with your payment to the: Unemployment Insurance Agency, P.O. Box 33598, Detroit, MI 48232-5598. Under the "Accounts" tab click "UI Tax." under the accounts tab click UI tax 2. Authorized By. MCL 421.1 et seq. The UI tax funds unemployment compensation programs for eligible employees. If the preference is to have the payment applied to a specific quarter, submit payment with a payment voucher UIA-4101-Employers-Tax-Payment-Coupon.pdf. Form UIA 4101 is used as a payment transmittal when mailing a quarterly payment.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.