Loading

Get Va Form Rdc 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form RDC online

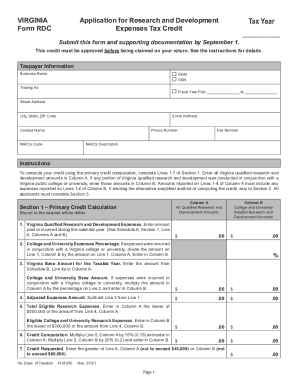

The VA Form RDC is essential for claiming the Research and Development Expenses Tax Credit. This guide will provide comprehensive, step-by-step instructions on how to complete the form online, ensuring that you can navigate the process with confidence.

Follow the steps to successfully complete your VA Form RDC online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering your taxpayer information, including your business name, FEIN, SSN, street address, and contact information. Make sure to use accurate details to avoid any processing delays.

- Identify the tax year for which you are applying and fill in the fiscal year duration, if applicable. Ensure that all information corresponds with your business records.

- Proceed to Section 1 and complete Lines 1-7 by entering the Virginia qualified research and development amounts. Be meticulous with calculations, rounding to the nearest whole dollar as required.

- If your research was conducted in conjunction with a Virginia college or university, provide those amounts in Column B where indicated.

- Continue to fill out Section 2 if opting for the alternative simplified credit calculation. Follow the instructions to determine and enter the adjusted expenses.

- Complete Section 3 by answering questions related to the number of employees and the nature of your research activities. Provide a description and supporting documentation as necessary.

- Review all entered information for accuracy before saving your changes. Ensure all required documents are included.

- After completing the form, you can download, print, or share the form as needed. Remember to submit your application before the deadline.

Complete your VA Form RDC online today and ensure your tax credits are filed correctly.

Do not attach correspondence or other items unless required to do so. Attach Forms W-2 and 2439 to the front of Form 1040. If you received a Form W-2c (a corrected Form W-2), attach your original Forms W-2 and any Forms W-2c. Attach Forms W-2G and 1099-R to the front of Form 1040 if tax was withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.