Loading

Get Va Dot Va-5 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT VA-5 online

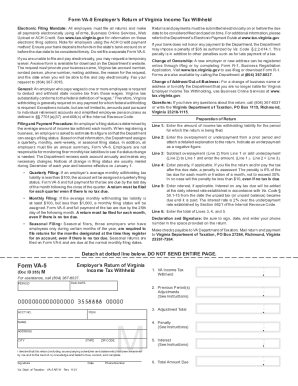

The VA DoT VA-5 is the Employer’s Return of Virginia Income Tax Withheld, which must be filed electronically by all employers. This guide provides clear steps to assist users in completing this important document online.

Follow the steps to fill out the VA DoT VA-5 online effectively.

- Click the ‘Get Form’ button to obtain the VA-5 form and open it in the online editor.

- Enter the period for which you are filing the return in the designated box.

- Provide the due date for the return in the provided field.

- Fill in your account number and Federal Employer Identification Number (FEIN) in the appropriate sections.

- In Line 1, enter the total amount of Virginia income tax withheld for the specified period.

- For Line 2, include any adjustments for previous periods: enter any overpayment as a positive amount and any underpayment as a negative amount.

- Complete Line 3 by calculating the total adjustment: subtract the overpayment (if applicable) or add the underpayment to the amount from Line 1.

- If a penalty applies, enter the amount in Line 4, which is based on the filing date and due tax amount.

- If applicable, include any interest owed in Line 5, calculated from the due date until payment.

- Calculate the total amount due and enter it in Line 6 by adding Lines 3, 4, and 5.

- Sign and date the form in the designated area, entering your phone number as well.

- After reviewing the completed form, proceed to save changes, and choose an option to download, print, or share the document.

Complete your VA DoT VA-5 online to ensure timely filing and compliance.

The purpose of IRS Form 1099-S is to ensure that the full amount of gross proceeds from sales are being reported to the IRS each year. If you have received a Form 1099-S, it must be included on your tax return. ... And the 1099-S is issued to the seller, who must report the sale on their personal income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.