Loading

Get In Bc-100 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN BC-100 online

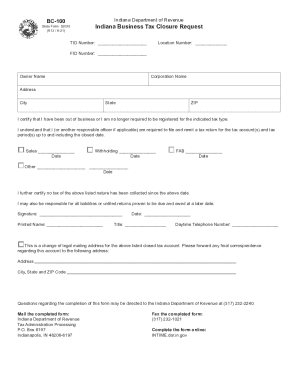

This guide will provide you with clear and detailed instructions on how to complete the Indiana Business Tax Closure Request form, also known as the IN BC-100, online. Whether you are a business owner or a responsible officer, our step-by-step approach aims to simplify the process for you.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to acquire the IN BC-100 form and open it in your preferred online editor.

- Begin filling out the form with your Tax Identification Number (TID Number), Location Number, and Federal Identification Number (FID Number). Make sure to double-check these numbers for accuracy.

- Provide the Owner Name and Corporation Name in the designated fields. This identifies the business that is requesting closure.

- Fill out the Address, City, State, and ZIP Code to ensure the Indiana Department of Revenue knows where to correspond regarding your tax account.

- In the certification section, indicate whether you have been out of business or are no longer required to be registered for the specified tax type. Ensure you check the appropriate boxes for Sales, Withholding, FAB, or any Other tax categories, and fill in the corresponding dates.

- Acknowledge your understanding of any tax return obligations up to the closure date. It is important to certify that no tax of the listed nature has been collected since the specified date.

- Sign and date the form in the designated fields, adding your printed name and title. This verifies that the information provided is accurate.

- Enter your daytime telephone number to facilitate any necessary follow-up communication.

- If applicable, provide a new mailing address for forwarding any final correspondence related to the closed tax account.

- Once all sections are completed, you may save your changes, download the completed form, print it out, or share it as needed.

Complete your documents online for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Hold a meeting of the members of your LLC and vote to officially dissolve the LLC. Each state has different requirements for the vote. You may need a majority, two-thirds, or a unanimous written agreement to dissolve an LLC, so check your state's rules.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.