Loading

Get In Dor Bas-1 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR BAS-1 online

This guide will walk you through the process of filling out the Indiana Department of Revenue BAS-1 form online. By following these detailed steps, you will be well-equipped to complete the application accurately and efficiently.

Follow the steps to fill out the form seamlessly.

- Press the ‘Get Form’ button to obtain the BAS-1 form and open it in your online editor.

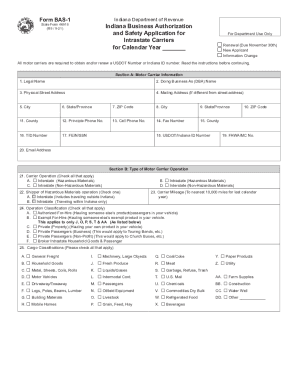

- Begin with Section A: Motor Carrier Information. Enter the legal name of your business as registered (Line 1). If you operate under a different name, provide that information in Line 2.

- Continue filling Section A by completing Lines 3 through 20. These lines require you to provide your physical address, mailing address, contact information, and your USDOT/Indiana ID number.

- Move on to Section B. In Line 21, check the appropriate type of carrier operation that indicates whether your activity includes interstate or intrastate operation, hazardous or non-hazardous materials.

- Next, complete Lines 22 through 28A in Section B. Provide information about your shipper operation, carrier mileage, and details about your operation classification and cargo classifications.

- Proceed to Section C: Business Type. Indicate the type of business organization you are (Line 29) and fill in your proof of public liability security in Line 30.

- Conclude by signing the certification statement in Line 31. Ensure an authorized person fills out and signs this section, including their title and date.

- Finally, review all entries for accuracy, save your changes, and choose to download, print, or share the completed BAS-1 form as needed.

Complete your IN DoR BAS-1 form online today for a smoother application process.

Withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employee's paycheck. ... The more allowances you claim, the less income tax will be withheld from a paycheck; the fewer allowances you claim, the more tax will be withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.