Loading

Get In Form Bt-1 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form BT-1 online

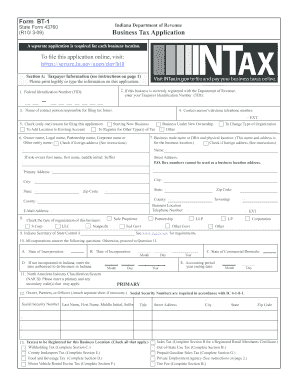

Filling out the IN Form BT-1 is essential for businesses registering for various tax types with the Indiana Department of Revenue. This guide provides a clear, step-by-step approach to help you successfully complete the form online.

Follow the steps to complete the IN Form BT-1 online.

- Click 'Get Form' button to access the IN Form BT-1 and open it in your browser.

- Provide your Federal Identification Number (FID) in the specified field. This number is vital for tax purposes and is usually given to partnerships and corporations.

- Enter your Taxpayer Identification Number (TID) if your business is already registered with the Department of Revenue. This ensures your application is linked to your existing records.

- Fill in the details of the contact person who is responsible for tax filings, including their name and daytime telephone number.

- Indicate the reason for submitting the form by checking the appropriate box. Options include starting a new business or changing the type of organization.

- Fill in the business name, including any trade names, along with the physical address of the business. Make sure to provide a complete address without using P.O. Box numbers.

- Complete the ownership information by entering the owner name or partnership details as applicable.

- If your business is a corporation, complete the additional questions related to incorporation, including state, date, and controlling information.

- Specify the North American Industry Classification System (NAICS) codes that correspond to your business activities, entering the primary and any secondary codes.

- List the owners, partners, or officers of the business along with their Social Security Numbers as required. Ensure to attach additional sheets if necessary.

- Select the types of tax your business will be registering for by checking all applicable options.

- Review all entered information for accuracy and legibility, as any mistakes may lead to processing delays.

- Sign the completed application with the signature of the person authorized to certify the application, indicating their title and the date.

- Once fully completed, you can save changes, download, print, or share the form as needed.

Complete your application for IN Form BT-1 online today to ensure your business is properly registered for taxes.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To be considered exempt from taxes, you must meet specific criteria established by state tax laws, which can vary widely. Common exemptions include non-profit status, low income, and specific business activities. Understanding these qualifications is crucial; thus, utilizing the IN Form BT-1 can provide clarity and assist in your application.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.