Get In Form Bt-1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form BT-1 online

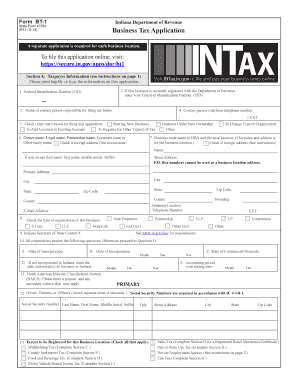

Filling out the IN Form BT-1 is a crucial process for businesses registering for various taxes with the Indiana Department of Revenue. This guide provides step-by-step instructions to ensure users can navigate the online application efficiently and accurately.

Follow the steps to complete the IN Form BT-1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section A, Taxpayer Information, enter your Federal Identification Number (FID) on the appropriate line. If your business is already registered, include your Taxpayer Identification Number (TID).

- Provide the name and daytime telephone number of a contact person responsible for filing tax forms.

- Select the purpose of the application by checking the appropriate box, indicating whether you are starting a new business, changing ownership, or registering for other tax types.

- Input the legal name of the business, trade name if applicable, and the business address. Ensure you provide a physical location and not a P.O. Box.

- Indicate the type of organization your business represents, choosing from options such as sole proprietor, partnership, or corporation.

- If applicable, complete the section related to the corporation, including state and date of incorporation, and other required details.

- Enter any relevant NAICS codes that apply to your business activities. You may list multiple codes if they apply.

- Fill in details regarding owners, partners, or officers, ensuring that social security numbers and addresses are included.

- In the tax registration section, check all applicable taxes your business will register for, ensuring to follow any additional instructions related to those taxes.

- Review your entries for accuracy. Once complete, you can save your changes, download a copy, print, or share the form as needed.

Begin completing your IN Form BT-1 online today to ensure your business is properly registered with the Indiana Department of Revenue.

Get form

Related links form

A reciprocal tax agreement is a mutual arrangement between two states that allows residents of one state to work in the other without incurring double taxation. This agreement is especially important for minimizing tax bills and promoting cross-border employment. Utilizing the IN Form BT-1 is essential for ensuring compliance when taking advantage of such agreements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.