Loading

Get In Form Bt-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form BT-1 online

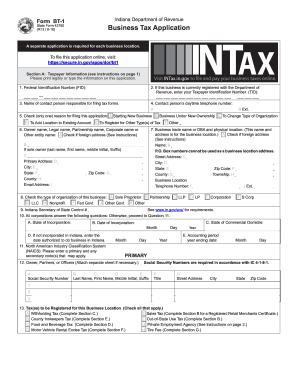

Filling out the IN Form BT-1 online is an essential step for individuals and organizations registering for business taxes in Indiana. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the IN Form BT-1 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section A, provide your taxpayer information. Enter your Federal Identification Number (FID) if you have one. If you are already registered, add your Taxpayer Identification Number (TID), followed by your contact person's name and daytime telephone number.

- Select the reason for filing the application by checking one option: Starting New Business, Business Under New Ownership, To Change Type of Organization, To Add Location to Existing Account, or To Register for Other Type(s) of Tax.

- Enter the name of the business owner or legal entity and the physical business trade name, along with the complete address. Make sure to avoid using P.O. Box numbers for the business location.

- Indicate the type of organization by checking the appropriate box for Sole Proprietor, Partnership, LLC, Corporation, etc.

- If applicable, complete the corporation-specific questions, such as the state of incorporation and date of incorporation before moving to the next section.

- Fill in the North American Industry Classification System (NAICS) code(s) that apply to your business activities.

- List the owners, partners, or officers of the business, ensuring to include their Social Security numbers and contact details.

- In Section B, check boxes for the tax types you wish to register for, providing additional information as required for Sales Tax, Withholding Tax, etc.

- Review all the information entered to ensure accuracy and completeness. Make any necessary corrections.

- After completing the form, you can save your changes, download, print, or share the completed form as needed.

Start filling out your IN Form BT-1 online today to ensure your business is registered correctly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The employee's withholding certificate is completed by the employee themselves when they start a new job or wish to make changes to their tax withholding status. It is imperative that employees provide accurate information to ensure correct withholding. Employers may assist by offering resources, such as guides on completing the IN Form BT-1.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.