Loading

Get In Form 11274 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form 11274 online

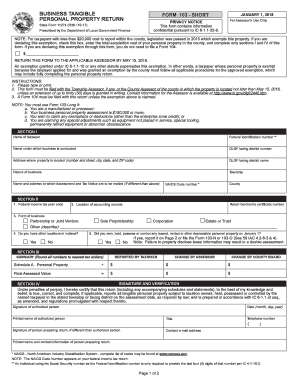

Completing the IN Form 11274 online is a crucial step in accurately reporting your business tangible personal property. This guide will provide you with clear, step-by-step instructions to ensure that you fill out the form correctly and comply with all necessary regulations.

Follow the steps to complete the IN Form 11274 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section I, entering the name of the taxpayer and the federal identification number in the respective fields. Complete the business name, address, and nature of the business as required.

- In Section II, provide the federal income tax year ending date and the location of your accounting records. Indicate the form of business structure and specify whether you have other locations in Indiana.

- For Section III, summarize your reported tangible personal property values, ensuring to round all numbers to the nearest ten dollars. If applicable, include any changes made by the assessor or county board.

- Move to Section IV and certify the information by signing and dating the document. Ensure the printed name and title of the authorized person are included, as well as their contact information.

- Finally, review all sections for accuracy. Save changes, then download, print, or share the completed form as needed. Ensure to return the form to the appropriate assessor by the specified deadline.

Start filling out your IN Form 11274 online today to ensure compliance and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A declaration form should include your identification information and details about what is being declared. Depending on the context, it may require specific facts, figures, and signatures to validate your claims. For assistance with the necessary components in the IN Form 11274, consider utilizing platforms like uslegalforms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.