Loading

Get Tx Comptroller 05-102 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-102 online

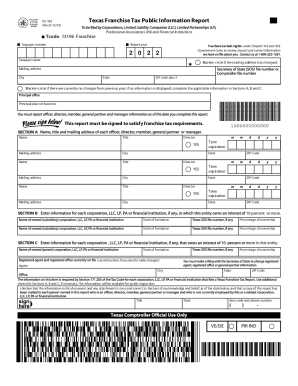

The TX Comptroller 05-102 form is essential for reporting franchise tax information in Texas. This guide provides clear, step-by-step instructions to assist users in completing the form accurately online.

Follow the steps to successfully complete the TX Comptroller 05-102 form.

- Click ‘Get Form’ button to obtain the TX Comptroller 05-102 form and access it in the editing tool.

- Enter the report year at the top of the form. Make sure you input the correct year for which you are filing.

- Provide your taxpayer number in the designated field. This number is unique to your business and is necessary for identification.

- Input your taxpayer name in the field provided. Ensure this matches the name associated with the taxpayer number.

- Indicate if your mailing address has changed by blackening the circle. If there are no changes, blacken the corresponding circle.

- Complete the mailing address section, including city, state, and the ZIP code plus 4 digits.

- If applicable, fill out the principal place of business section with your current business address details.

- In Section A, list the names and titles of directors along with their mailing addresses, cities, states, and ZIP codes.

- Fill in Section B with information about the state of formation and percentage of ownership for each director listed.

- Use Section C for additional information regarding the entity’s agent, including their address details.

- Review all information for accuracy, ensuring that all required fields are filled out correctly.

- Sign and date the document as required to fulfill franchise tax responsibilities before submitting.

- Once completed, save changes, then opt to download, print, or share the completed form as needed.

Complete your documents online today to ensure your filings are accurate and timely.

All taxable entities must file a franchise tax report, regardless of annual revenue. The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.