Loading

Get Tx Comptroller 05-164 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-164 online

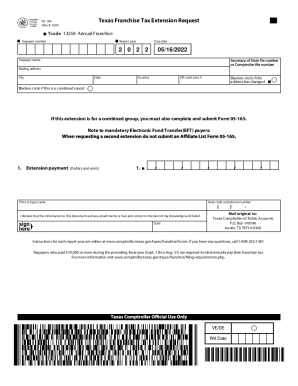

The TX Comptroller 05-164 form is essential for individuals seeking to request an extension for franchise tax filings in Texas. This guide provides you with clear, step-by-step instructions to help you confidently complete the form online.

Follow the steps to successfully fill out the TX Comptroller 05-164 form online.

- Click ‘Get Form’ button to access the form and open it in your preferred document editor.

- Fill in your taxpayer number in the designated field. This number is crucial for identification purposes.

- Enter the report year for which you are requesting the extension. Make sure to choose the correct fiscal year.

- Indicate the due date for the tax submission. It is typically set for May 15th of the reporting year.

- Provide your taxpayer name, mailing address, city, state, ZIP code plus 4, and country in the respective boxes.

- If your address has changed, blacken the circle next to that option to indicate the update.

- If you are filing a combined report, signify this by blackening the appropriate circle. If so, remember to complete and submit Form 05-165 as well.

- For mandatory electronic fund transfer (EFT) payers, enter the amount of extension payment in dollars and cents.

- Print or type your name in the designated area and provide your area code and phone number.

- Sign and date the declaration that confirms the information provided is true and correct to the best of your knowledge.

- Finally, review your form for accuracy, and once satisfied, save your changes, download it, print, or share as required.

Begin filling out your TX Comptroller 05-164 form online today to ensure timely compliance with your franchise tax obligations.

All taxable entities must file a franchise tax report, regardless of annual revenue. The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.