Loading

Get Ar Tax Tables 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR Tax Tables online

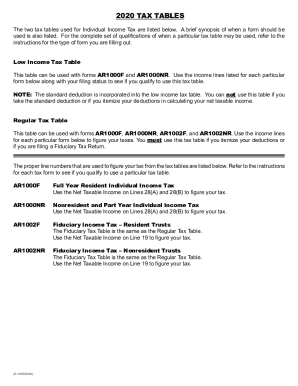

The AR Tax Tables provide crucial information for calculating individual income tax based on your filing status and net taxable income. Understanding how to fill out these tables online can ensure accurate tax reporting and compliance.

Follow the steps to complete the AR Tax Tables accurately

- Click 'Get Form' button to obtain the AR Tax Tables form and open it in your chosen online platform.

- Identify your filing status—this information is essential as it determines which tax table you will need to use.

- Locate your net taxable income on the appropriate lines corresponding to your filing status. This income is typically found on lines 28(A) and 28(B) for forms AR1000F and AR1000NR.

- Consult the Low Income Tax Table if you qualify based on your total income and filing status. Verify that you haven't taken the standard deduction or itemized your deductions.

- If you itemize deductions or are filing a Fiduciary Tax Return, use the Regular Tax Table instead. Ensure that you have subtracted any applicable deductions from your net income before referencing this table.

- Find the applicable tax amount in the table based on your income range. This value represents your tax obligation.

- Record the calculated tax on the appropriate line of your AR1000F or AR1000NR form (for example, Line 29).

- Once you've completed filling out the necessary fields, you can save changes, download the form for your records, print a copy, or share it as needed.

Complete your AR Tax Tables online today for accurate and efficient filing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

While bonuses are subject to income taxes, they don't simply get added to your income and taxed at your top marginal tax rate. Instead, your bonus counts as supplemental income and is subject to federal withholding at a 22% flat rate.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.