Loading

Get Ct Forms 1099-r 1099-misc And W-2g Electronic Filing Requirements 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT Forms 1099-R 1099-MISC And W-2G Electronic Filing Requirements online

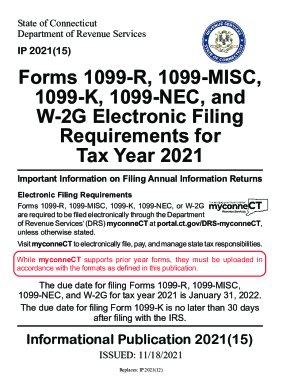

Filing the CT Forms 1099-R, 1099-MISC, and W-2G electronically is essential for ensuring compliance with state revenue requirements. This guide provides straightforward steps for users, regardless of their prior experience, to successfully complete these forms online.

Follow the steps to fill out the forms correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the general instructions provided in the form to understand the context for different fields. Gather all necessary financial information and documentation before starting.

- Begin filling out the form by entering the Transmitter T Record information. Ensure accuracy for fields such as your TIN and contact details.

- Proceed to complete the Payer A Record section, providing details about the payer, including the payer's TIN and associated payment types.

- Fill out the Payee B Record accurately, including the payee's TIN and relevant payment amounts for each corresponding code provided in the A Record.

- Once all payee records are entered, include an End of Payer C Record summarizing the number of payees and total payment amounts.

- Finalize the process by entering the End of Transmission F Record to indicate that all information has been submitted and ensure compliance.

- Review your entries for accuracy, and then utilize the options to save changes, download, print, or share the completed form.

Complete your CT Forms 1099-R, 1099-MISC and W-2G filings online today to ensure timely compliance.

The IRS has an online Get Transcript" tool on IRS.gov that lets you download or receive by email or mail transcripts of your prior return. Taxpayers can also request transcripts of prior year returns by mailing a completed copy of the paper Form 4506 to the IRS. The form can be downloaded at IRS.gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.