Loading

Get Ct Drs Schedule Ct-si 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS Schedule CT-SI online

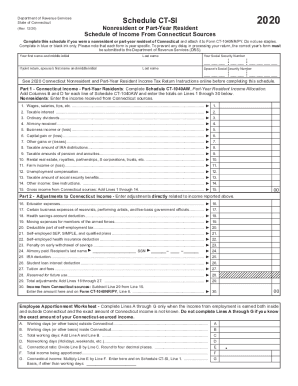

The CT DRS Schedule CT-SI is essential for nonresidents or part-year residents of Connecticut to report income sourced from Connecticut. This guide provides you with a clear and straightforward approach to accurately complete the form online, ensuring efficient processing of your income tax return.

Follow the steps to accurately complete the Schedule CT-SI online.

- Click ‘Get Form’ button to access the form and open it in your document editor.

- Begin by filling in your first name and middle initial in the designated field, followed by your last name. If you are filing jointly, include your spouse’s first name and middle initial, as well as their last name.

- Enter your Social Security Number in the specified format and ensure accuracy. If applicable, also provide your spouse’s Social Security Number in the next available field.

- Refer to the 2020 Connecticut Nonresident and Part-Year Resident Income Tax Return Instructions online before proceeding with the schedule. This will provide essential guidance.

- In Part 1, if you are a part-year resident, complete Schedule CT-1040AW to allocate your income. For nonresidents, enter your income received from Connecticut sources in the lines provided, including wages, interest, dividends, business income, and other specified types of income.

- In Part 2, list any adjustments to your Connecticut income that are directly related to the income reported in Part 1. This may include educator expenses, health savings account deductions, and student loan interest deductions.

- Calculate your total adjustments and subtract this amount from your gross income from Connecticut sources, as indicated in the final line of Part 2.

- Complete the Employee Apportionment Worksheet only if your income is earned both inside and outside Connecticut. Fill in the fields regarding working days and the resulting Connecticut ratio.

- Once all sections are filled out, review your entries for accuracy. You can then save changes, download, print, or share the completed form as needed.

Complete your CT DRS Schedule CT-SI online today to ensure a prompt and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The GOP tax law will also make many Connecticut residents happy this year. Those who don't itemize will benefit from a doubling of the standard deduction of $12,000 for single filers and $24,000 for married couples. ... Many of the state's wealthiest residents will also benefit.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.