Get In Dor Wh-3 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IN DoR WH-3 online

How to fill out and sign IN DoR WH-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Enrolling your earnings and stating all the necessary taxation paperwork, such as IN DoR WH-3, is a responsibility of a US citizen. US Legal Forms simplifies your tax management significantly and accurately.

You can obtain any legal templates you need and complete them electronically.

Safeguard your IN DoR WH-3. Ensure that all your relevant documents and information are organized while being aware of the deadlines and tax regulations established by the IRS. Simplify it with US Legal Forms!

- Access IN DoR WH-3 using your web browser on your device.

- Select the fillable PDF document with a click.

- Begin completing the online template box by box, following the guidelines provided by the advanced PDF editor's interface.

- Carefully enter text and figures.

- Click on the Date field to automatically set the current date or edit it manually.

- Utilize the Signature Wizard to create your unique e-signature and verify in seconds.

- Consult the IRS guidelines if you have any further questions.

- Click on Done to finalize the modifications.

- Proceed to print the document, download it, or share it via Email, SMS, Fax, or USPS without leaving your web browser.

How to Revise Get IN DoR WH-3 2015: Tailor Forms Online

Utilize our sophisticated editor to convert a basic online template into a finalized document. Continue reading to discover how to easily modify Get IN DoR WH-3 2015 online.

Once you locate the perfect Get IN DoR WH-3 2015, all you have to do is modify the template according to your requirements or legal obligations. Besides filling in the editable form with precise details, you may also need to remove certain clauses in the document that do not pertain to your case. Conversely, you might want to incorporate any missing stipulations in the original template. Our advanced document editing features are the easiest way to adjust and amend the document.

The editor permits you to alter the content of any form, even if the file is in PDF format. You can add and delete text, insert fillable fields, and make additional modifications while preserving the original layout of the document. Additionally, you can rearrange the organization of the document by modifying the page sequence.

You do not need to print the Get IN DoR WH-3 2015 to sign it. The editor comes equipped with electronic signature functionalities. Most forms already contain signature fields, so you only need to place your signature and request one from the other signing parties via email.

Follow this step-by-step guide to create your Get IN DoR WH-3 2015:

Once all parties have finalized the document, you will receive a signed copy which you can download, print, and share with others.

Our solutions enable you to save a significant amount of time and reduce the possibility of errors in your documents. Enhance your document processes with effective editing features and a robust electronic signature system.

- Open the desired form.

- Utilize the toolbar to modify the template to your liking.

- Fill in the form with accurate information.

- Click on the signature field and add your electronic signature.

- Send the document for signature to other signers if necessary.

Related links form

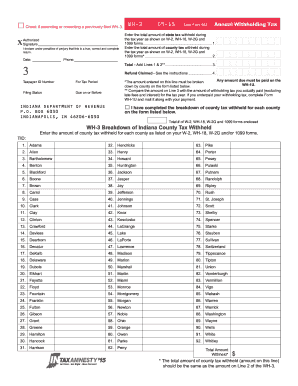

The number of exemptions you should claim in Indiana often depends on your individual circumstances like dependents or other deductions. It is advisable to carefully assess your financial picture and review the guidelines on the IN DoR WH-3. This careful evaluation will assist you in optimizing your tax withholdings and avoiding surprises during tax season.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.