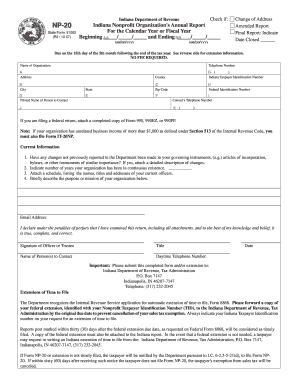

Get In Dor Np-20 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IN DoR NP-20 online

How to fill out and sign IN DoR NP-20 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and submitting all vital tax documents, including IN DoR NP-20, is a US citizen's sole responsibility. US Legal Forms enhances your tax filing experience, making it simpler and more efficient. You can locate any legal templates you require and fill them out online.

How to create IN DoR NP-20 online:

Store your IN DoR NP-20 safely. Ensure that all your accurate documents and records are organized while keeping in mind the deadlines and tax regulations set by the IRS. Simplify the process with US Legal Forms!

- Obtain IN DoR NP-20 in your web browser using your device.

- Open the editable PDF document by clicking.

- Start filling out the online template field by field, adhering to the instructions of the advanced PDF editor's interface.

- Precisely enter text and numbers.

- Click the Date box to automatically set today’s date or modify it manually.

- Utilize Signature Wizard to create your personalized e-signature and authenticate it in moments.

- Refer to the Internal Revenue Service guidelines if you still have questions.

- Press Done to save your changes.

- Continue to print the document, download it, or share it via email, text message, fax, or USPS without leaving your browser.

How to Modify Get IN DoR NP-20 2007: Personalize Forms Online

Ditch the outdated paper-based method of handling Get IN DoR NP-20 2007. Complete and validate the document swiftly using our expert online editor.

Are you struggling to revise and finalize Get IN DoR NP-20 2007? With a powerful editor like ours, you can accomplish this in mere minutes without the hassle of printing and scanning repeatedly. We offer fully customizable and straightforward document templates that will act as a foundation and assist you in filling out the required document template online.

All forms inherently include fillable fields that you can utilize as soon as you open the form. However, if you need to enhance the current content of the document or add new information, you can choose from a variety of editing and annotation tools. Emphasize, black out, and annotate the document; integrate checkmarks, lines, text boxes, images, notes, and comments. Additionally, you can effortlessly certify the form with a legally-recognized signature. The finalized document can be shared with others, stored, sent to external applications, or converted into any other format.

You’ll always make the right choice using our web-based solution to handle Get IN DoR NP-20 2007 because it's:

Don't waste time altering your Get IN DoR NP-20 2007 the traditional way - with a pen and paper. Opt for our feature-rich solution instead. It offers you an exhaustive range of editing tools, integrated eSignature capabilities, and user-friendliness. What sets it apart from similar alternatives is the team collaboration features - you can work on documents with anyone, create a well-structured document approval process from scratch, and much more. Experience our online solution and get great value for your investment!

- Simple to establish and utilize, even for users who haven't filled out documents electronically before.

- Sufficiently robust to accommodate various modification needs and document types.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible across multiple operating systems, making it easy to finish the document from anywhere.

- Able to generate forms based on pre-designed templates.

- Compatible with various document formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

To obtain your sales tax exempt number, you need to apply through the Indiana Department of Revenue. Gather necessary documentation verifying your non-profit status before applying. Following the instructions for the IN DoR NP-20 will help streamline this process and ensure you receive your exemption efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.