Loading

Get In Dor Np-20 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR NP-20 online

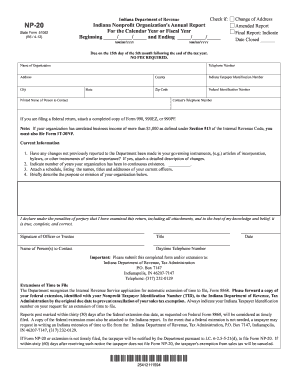

Filing the Indiana Nonprofit Organization's Annual Report, known as Form NP-20, is essential for maintaining your organization's compliance. This guide will walk you through the process of completing this form online, ensuring you provide all necessary information accurately.

Follow the steps to complete the IN DoR NP-20 online

- Press the ‘Get Form’ button to access the form and launch it in your editor.

- Begin by entering the organization's name in the designated field, followed by your organization’s telephone number, address, city, county, state, Indiana Taxpayer Identification Number, federal identification number, and zip code.

- Provide the printed name of the person to contact, along with their telephone number.

- If applicable, attach a completed copy of Form 990, 990EZ, or 990PF, especially if your organization is filing a federal return.

- Indicate any changes made to your governing instruments, such as articles of incorporation or bylaws, that have not previously been reported. If yes, attach a detailed description of these changes.

- Enter the number of years your organization has been in continuous existence.

- Attach a schedule listing the names, titles, and addresses of your current officers.

- Provide a brief description of your organization’s purpose or mission in the designated space.

- Complete the email address section for further communication.

- Declare the accuracy of your report by signing in the designated area, including your title, the name of person(s) to contact, the date, and the daytime telephone number.

- Once all fields are complete, you can save your changes, download the form, print it, or share it as necessary.

Ensure your organization remains compliant by completing the IN DoR NP-20 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain your sales tax exempt number in Indiana, you must first register your nonprofit with the Indiana Department of Revenue. After registration, you can apply for the exemption by completing the necessary forms, including information related to the IN DoR NP-20. Uslegalforms offers helpful templates and guidance to streamline this process for you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.