Loading

Get In Dor It-40x 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR IT-40X online

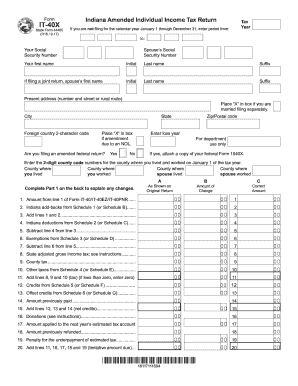

The Indiana Amended Individual Income Tax Return, known as Form IT-40X, allows users to correct or update a previously filed tax return. This guide will provide clear, step-by-step instructions for filling out this form online, ensuring a smooth and accurate submission.

Follow the steps to complete your IT-40X form efficiently.

- Click ‘Get Form’ button to access the IT-40X form and open it in your online editing tool.

- Enter the tax year you are amending at the top of the form, using the format for your specific tax year.

- Input your Social Security number and your spouse’s Social Security number if filing jointly.

- Provide your and your spouse's first names, initials, last names, and suffixes as applicable.

- Fill in your current address, including street number and name, city, state, and zip code.

- Select the relevant boxes indicating if you are married filing separately or if the amendment is due to a net operating loss.

- Indicate whether you are also filing an amended federal return by selecting 'Yes' or 'No' and provide the loss year if applicable.

- Complete the county codes for where you and your spouse lived and worked as of January 1 of the tax year.

- In Part 1 on the back of the form, provide an explanation of the changes you are making, ensuring to include any required documentation.

- Fill in Column A with amounts from your original return, Column B with changes, and Column C with the correct amounts for lines related to your income, deductions, exemptions, and taxes.

- Calculate the refund or amount due by following the prompts on the form for lines 21 to 25.

- Review the authorization section, signing your name, and entering the date.

- Save your completed form, and consider downloading, printing, or sharing it as needed.

Start completing your IN DoR IT-40X online today for a smooth tax amendment process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Mail your Indiana state tax return to P.O. Box 7203, Indianapolis, IN 46207-7203. This is the correct address for the Indiana Department of Revenue. Always verify that your form, such as the IN DoR IT-40X, is fully completed before sending it in. Properly addressing your return helps avert potential processing delays.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.