Loading

Get In Dor It-20x 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR IT-20X online

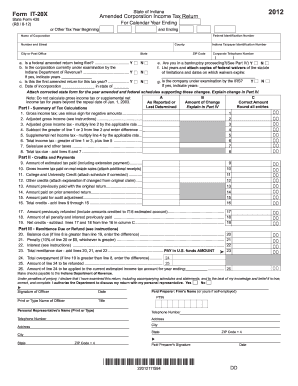

The IN DoR IT-20X is the Amended Corporation Income Tax Return form used by corporations in Indiana to amend previously filed tax returns. This guide provides clear, step-by-step instructions to assist you in filling out the form accurately and efficiently.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your federal identification number in the designated box in the upper-right corner of the form. This is a nine-digit number assigned to your corporation by the IRS.

- Fill in your Indiana taxpayer identification number. This number is necessary for processing your amendment within the state.

- Provide the corporation's name, address, city, state, county, and ZIP code in the appropriate fields. Ensure that all information is accurate and up-to-date.

- Answer the questions regarding federal amended returns, bankruptcy proceedings, and prior examinations by the Indiana Department of Revenue. Mark 'Y' for yes and 'N' for no as applicable.

- In Part I, summarize your tax calculations by completing lines 1 through 8 in columns A, B, and C. Attach any necessary documentation and explanations for changes made.

- In Part II, list your credits and payments. Complete lines 9 through 15 and provide a detailed explanation in Part IV of any changes from the original return.

- In Part III, compute any remittance due or refund amounts. Fill out lines 20 through 26 as directed, ensuring accuracy to prevent delays.

- In Part IV, provide a concise explanation of any changes made, and attach additional sheets if necessary to document those changes.

- Finally, review the entire form for accuracy. Sign, date, and print your name on the return. If a paid preparer completed your return, ensure they also sign it.

- Submit your completed form to the appropriate address based on whether you owe tax or not.

Get started and complete your IN DoR IT-20X online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

File a 1040x online by accessing the IRS website or using tax software that supports amended returns. You will need your original return and specific information about the changes you want to make. Ensure that you follow the prompts accurately for a smooth process. If Indiana taxes are involved, be sure to consider the IN DoR IT-20X for state-specific amendments.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.