Get In Dor Bas-1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR BAS-1 online

Filling out the Indiana Department of Revenue Business Authorization and Safety Application for Intrastate Carriers (BAS-1) can be a straightforward process with the right guidance. This comprehensive guide will help you complete the form accurately to ensure compliance with state requirements.

Follow the steps to successfully complete the IN DoR BAS-1 form.

- Press the ‘Get Form’ button to obtain the BAS-1 form and open it in your preferred editor.

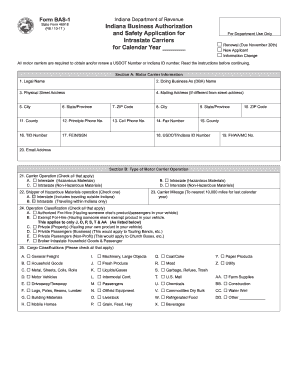

- In Section A, provide the motor carrier information. Fill in the legal name of your business in Line 1 and the doing business as (DBA) name in Line 2 if applicable. Complete Lines 3 to 20 with accurate details about your physical and mailing address, contact information, Federal Employer Identification Number (FEIN), and USDOT/Indiana ID number.

- In Section B, select the type of motor carrier operation that applies to your business on Lines 21 to 24. Ensure you check all applicable classifications for your operations and cargo on Lines 25 to 26, indicating the types of cargo you transport and any hazardous materials carried or shipped.

- In Section C, specify your business type in Line 29, detailing whether you are an individual, partnership, corporation, or LLC. Provide proof of public liability security in Line 30 by entering your insurance company's name, policy number, and effective date, and checking the appropriate box.

- Finally, complete Line 31 with the certification statement. An authorized official should sign, print their name, and indicate their title. Review all sections to ensure all required fields are completed before submission.

- After filling out the form, you can save the changes, download a copy for your records, or print the form directly. If necessary, share the completed form with the relevant authorities.

Start filling out your IN DoR BAS-1 form online today to ensure your business compliance.

Get form

Related links form

The BT-1 form in Indiana is the Business Tax Application used for registering your business with the Indiana Department of Revenue. This form gathers essential information about your business type, expected revenue, and the nature of your operations. Completing the BT-1 accurately is vital as it impacts your tax obligations. For assistance with this form, consider using USLegalForms, which offers straightforward guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.