Loading

Get In Dlgf Hc10 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DLGF HC10 online

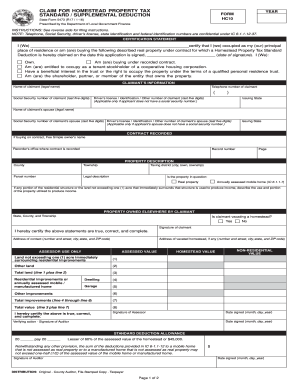

The IN DLGF HC10 form is essential for claiming a homestead property tax deduction in Indiana. This guide provides clear, step-by-step instructions on how to accurately complete the form online, ensuring you understand each component and your eligibility.

Follow the steps to fill out the IN DLGF HC10 form online:

- Press the ‘Get Form’ button to access the form and open it in your online workspace.

- In the certification statement, enter the name of the person or people claiming the homestead deduction, followed by the date you are signing the application.

- Fill in the claimant's information, including their legal name, telephone number, last five digits of their social security number, and the required identification details.

- If married, provide the same details for the claimant’s spouse. Ensure all information is accurate and complete to avoid delays.

- For individuals purchasing the property under a contract, indicate the fee simple owner's name, the recorder’s office where the contract is recorded, along with the record number and page.

- Describe the property accurately, including the county, township, and taxing district. Include the parcel number and legal description of the property.

- Indicate whether the property is real property or an annually assessed mobile home. If applicable, describe any portion of the property that is used to produce income.

- Complete the section regarding other properties owned by the claimant, including the state, county, and township for each additional property.

- Sign and date the certification statement, certifying that the statements made are true and complete.

- Review all entered information for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as needed.

Start filling out the IN DLGF HC10 form online today to secure your homestead property tax deduction!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, property taxes are usually deductible on your federal tax return as an itemized deduction. Review the IRS guidelines to confirm your eligibility, as deducting property taxes can lower your overall taxable income. Additionally, programs like IN DLGF HC10 help streamline the deduction process for Indiana residents.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.